Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

How Huge We Are: U.S. Natural Gas Pipelines Infrastructure 2024 Overview by Rextag

08/02/2024

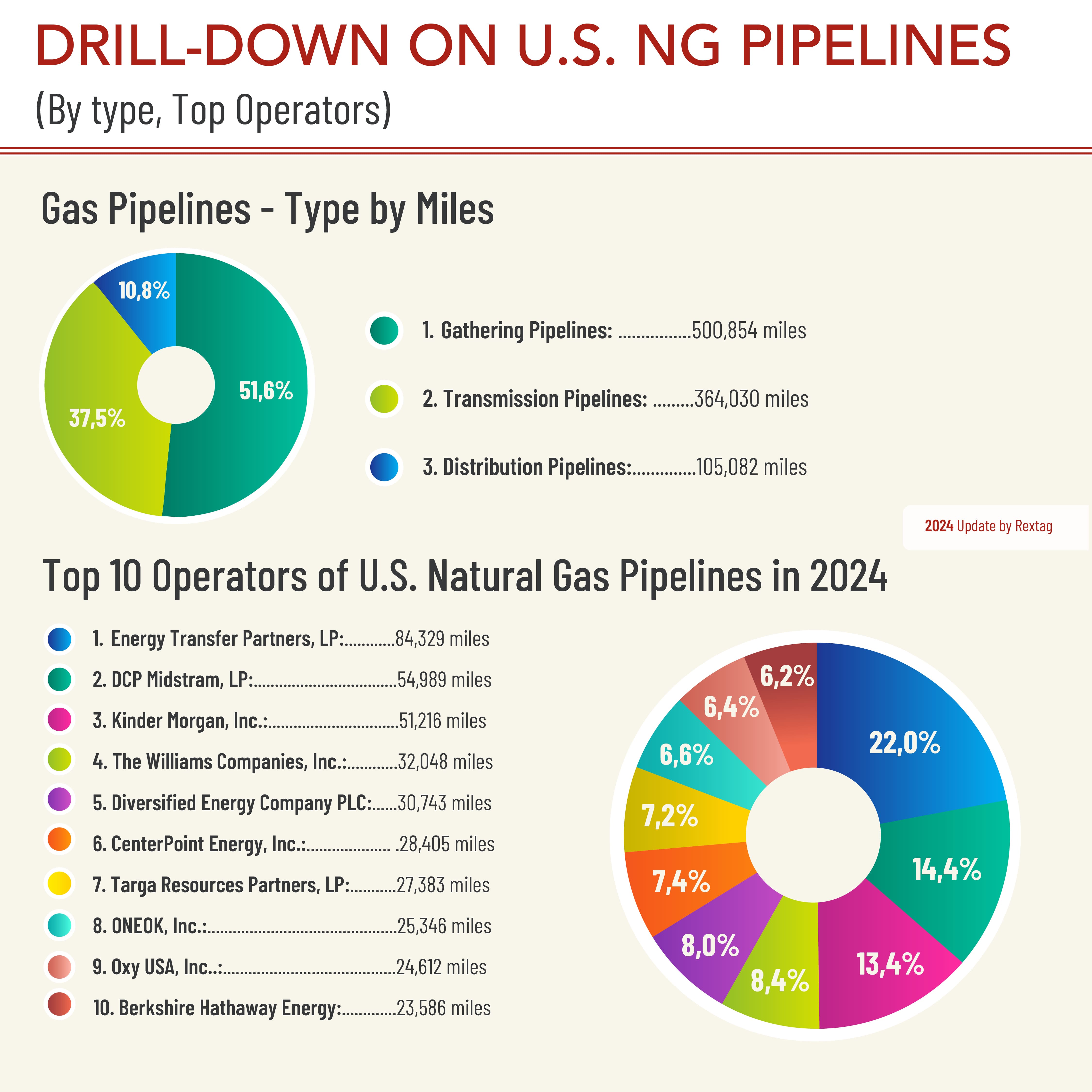

The U.S. natural gas pipeline network is a complex pipeline system that transports natural gas from production areas to consumers nationwide. The pipeline network consists of three main pipeline types: gathering, transmission, and distribution.

In 2023, the U.S. had one of the most extensive pipeline networks in the world, with over 2.5 million miles of pipelines transporting oil, natural gas, and other liquids and gases. The pipeline industry continues to invest in new infrastructure to meet growing demand and ensure reliable energy transportation.

(1).png)

In early 2023, gathering pipelines, which collect gas from production sites, led the way with 496,051 miles. Transmission pipelines, crucial for transporting gas over long distances, covered 361,945 miles. Distribution pipelines, responsible for delivering gas to homes and businesses, spanned 103,897 miles.

Top operators in this industry included Energy Transfer Partners, managing 38,733 miles, and DCP Midstream Partners with 33,606 miles. Diversified Energy Company handled 30,135 miles, CenterPoint Energy Resources managed 24,971 miles, and Enable Midstream Partners oversaw 23,716 miles.

.png)

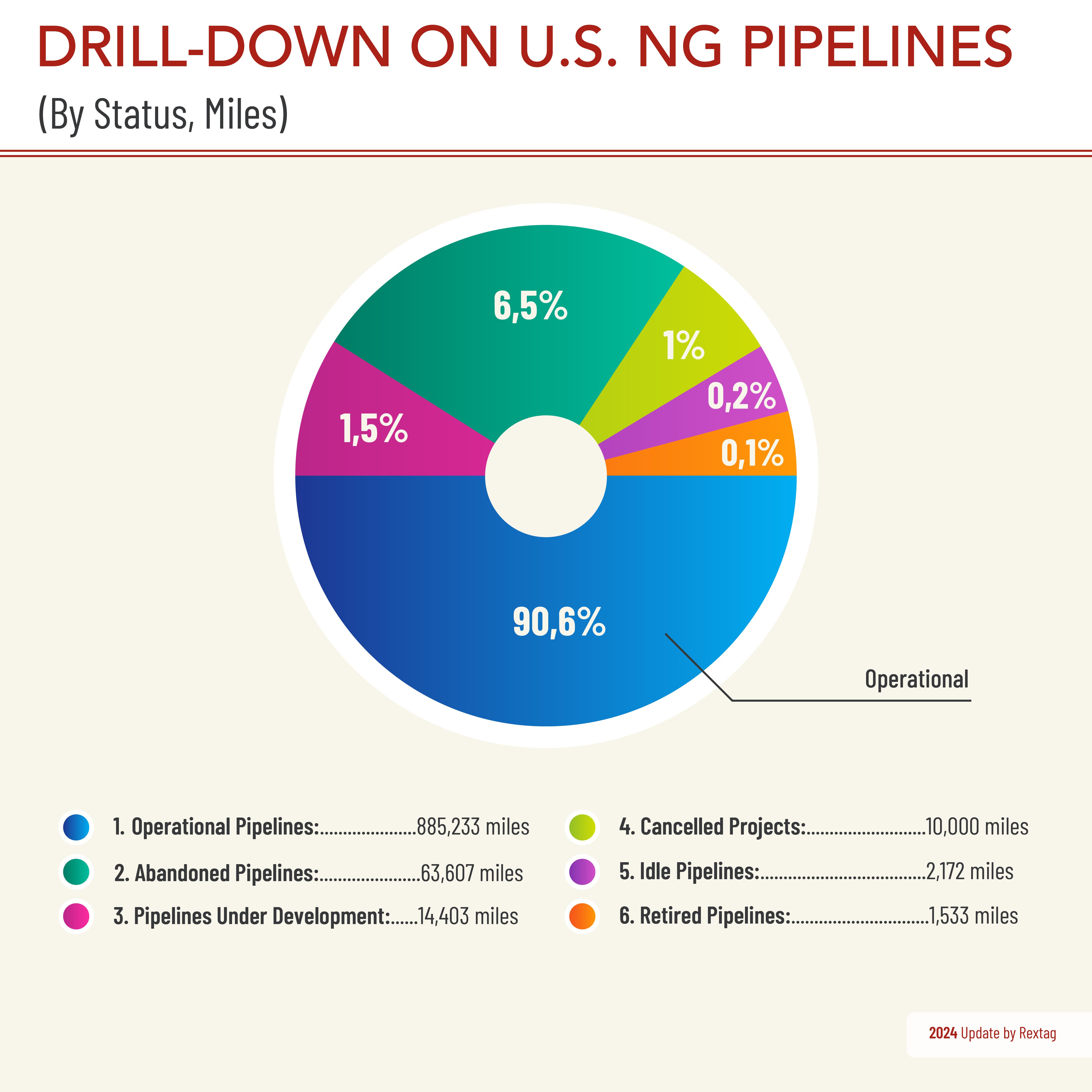

At that time, the status of the U.S. natural gas pipeline infrastructure was dominated by operational pipelines, which accounted for 877,759 miles, or 91.3% of the total. A notable portion, 58,437 miles, was abandoned. Pipelines under development covered 12,188 miles, while 9,625 miles were from cancelled projects. Additionally, there were 2,045 miles of idle pipelines and 1,836 miles that had been retired.

This is the 2023 wrap-up with some controversial projects you need to read — click here for the full story!

2023 vs 2024

Between early 2023 and mid-2024, the U.S. natural gas pipeline infrastructure saw a slight growth across all types of pipelines:

- Gathering Pipelines: Increased from 496,051 miles to 500,854 miles, representing a growth of 0.97%.

- Transmission Pipelines: Grew from 361,945 miles to 364,030 miles, which is a growth of 0.58%.

- Distribution Pipelines: Expanded from 103,897 miles to 105,082 miles, marking a growth of 1.14%.

Top Operators of U.S. Natural Gas Pipelines in 2024

- Energy Transfer Partners, LP - 84,329 miles

- DCP Midstream, LP (Phillips 66/Enbridge) - 54,989 miles

- Kinder Morgan, Inc. - 51,216 miles

- The Williams Companies, Inc. - 32,048 miles

- Diversified Energy Company PLC - 30,743 miles

- CenterPoint Energy, Inc. - 28,405 miles

- Targa Resources Partners, LP - 27,383 miles

- ONEOK, Inc. - 25,346 miles

- Oxy USA, Inc. - 24,612 miles

- Berkshire Hathaway Energy Company - 23,586 miles

U.S. Natural Gas Pipeline Status - 2023 vs 2024

|

Status |

Miles in 2023 |

Miles in 2024 |

|

Operational |

877 759 |

885 233 |

|

Under Development |

12 188 |

14 403 |

|

Abandoned |

58 437 |

63 607 |

|

Cancelled |

9 625 |

10 000 |

|

Idle |

2 045 |

2 172 |

|

Retired |

1 836 |

1 533 |

- Operational Pipelines: Increased from 877,759 miles to 885,233 miles, a growth of 0.85%.

- Pipelines Under Development: Grew significantly from 12,188 miles to 14,403 miles, marking a substantial increase of 18.17%.

- Abandoned Pipelines: Rose from 58,437 miles to 63,607 miles, reflecting a growth of 8.85%.

- Cancelled Projects: Increased slightly from 9,625 miles to 10,000 miles, which is a growth of 3.90%.

- Idle Pipelines: Went up from 2,045 miles to 2,172 miles, representing a growth of 6.21%.

- Retired Pipelines: Decreased from 1,836 miles to 1,533 miles, showing a reduction of 16.50%.

2024

North America has nearly 19,800 miles of pipeline either planned or under construction. Out of that total, about 8,700 miles are currently under construction, which is more than what was reported a year ago. Planned projects have also increased, with around 11,100 miles on the horizon, marking a 9.5% increase compared to last year.

In regions like the Marcellus and Utica shale, natural gas production growth is still limited due to pipeline bottlenecks. Meanwhile, pipelines carrying gas from the Permian Basin and Haynesville to the Gulf Coast are just beginning to catch up with short-term demand.

In the U.S., over 8 Bcf/d of pipeline capacity is either in the planning stages or already being built, particularly from the Permian and Haynesville basins. Pipeline operators are strategically positioning themselves around the LNG growth markets along the Texas and Louisiana Gulf coasts.

As part of this expansion, major midstream companies are growing even larger through ongoing acquisitions. Some of these are aimed at expanding gathering and processing capabilities to support existing long-haul pipelines. Others are focused on preparing for future LNG demand.

While much of this new capacity won't be operational for a few more years, the demand for natural gas is present and will need to be met with new pipeline projects. These projects include the development of new and expanded gathering systems, long-haul pipeline construction, compression expansions, and "last-mile" connections that link major transmission systems to specific areas and facilities.

Although timelines for LNG expansion can be unpredictable, often leading to underutilized new pipelines, the impact of these gaps will vary. For instance, Energy Transfer has already completed the 1.65 Bcf/d Gulf Run pipeline, which transports gas from north Louisiana to the coast. This project, acquired through the purchase of Enable Midstream in December 2021, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant, currently under construction in Texas by QatarEnergy and Exxon Mobil.

Haynesville

Williams announced in May 2022 that it was committing $1.5 billion to expand natural gas capacity and improve market access. A month later, they sanctioned the Louisiana Energy Gateway (LEG) project, designed to move 1.8 Bcf/d of Haynesville natural gas to various Gulf Coast markets. Williams, based in Tulsa, expects the LEG system to be operational by 2024-2025.

One of the major projects is DT Midstream's Louisiana Energy Access Pipeline (LEAP) expansion, which is being carried out in three stages. The existing LEAP Gathering Lateral Pipeline, a 155-mile line with a capacity of 1 billion cubic feet per day (Bcf/d), stretches from Haynesville to the Gulf Coast. DT Midstream plans to boost LEAP’s capacity by 90%, bringing it up to 1.9 Bcf/d through both compression and construction expansions.

Momentum Midstream is also working on a project called the New Generation Gas Gathering (NG3) system, which will connect Haynesville to coastal Louisiana LNG markets. The project involves building 275 miles of additional natural gas gathering pipelines with a capacity of 2.2 Bcf/d. NG3 will include a Carbon Capture and Sequestration (CCS) solution, providing producers with a net negative CO2 emission option. NG3 is expected to be completed in 2024.

Permian Basin

Most recent Permian Basin natural gas pipelines have been aimed at sending gas to LNG export markets south of Houston. However, two new intrastate projects are being planned to transport Permian Basin gas to the Texas-Louisiana border region.

The first and largest of these projects is Targa's 562-mile Apex pipeline. This pipeline, approved by the Railroad Commission of Texas in late March, will start in Midland County, West Texas, and stretch to Jefferson County, near the Louisiana border by Sabine Pass.

The second project is the 190-mile Blackfin Pipeline, proposed by WhiteWater Midstream, which filed for regulatory approval in February. The Blackfin Pipeline will start at the eastern edge of the Eagle Ford shale and will act mainly as an extension of the 580-mile Matterhorn Express Pipeline. The Matterhorn Express, which was approved in May 2022 by a joint venture including WhiteWater, EnLink Midstream, Devon Energy, and MPLX, is set to become operational in the third quarter of 2024. It will provide 2-2.5 billion cubic feet per day (Bcf/d) of gas takeaway capacity from the Permian Basin to the Katy area, west of Houston.

Blackfin will connect with the Matterhorn Express to alleviate pipeline congestion in the Katy area, and like the Apex pipeline, it will deliver gas to the Texas-Louisiana border. These new projects are focused on bringing Permian gas closer to LNG liquefaction facilities, a shift from the focus of earlier pipelines like Gulf Coast Express, Permian Highway, and Whistler.

NGL

ONEOK is doubling the capacity of its West Texas NGL pipeline, which will increase its ability to transport NGLs from the Permian Basin to 740,000 b/d. The project includes a connection to ONEOK’s Arbuckle II pipeline, which can move 500,000 b/d between Oklahoma and Mont Belvieu. ONEOK plans to complete this expansion by the first quarter of 2025.

Enterprise Products Partners LP is planning to build a new 550-mile Bahia NGL pipeline, which will transport up to 600,000 b/d of NGLs from the Delaware and Midland basins to their fractionation complex in Mont Belvieu. This pipeline will include a 24-inch diameter section from the Delaware Basin, connecting to a 30-inch section from the Midland Basin to Chambers County. The Bahia pipeline is expected to start operations in the first half of 2025 and could be expanded to handle up to 1 million b/d with additional pumps.

Targa is working on its Daytona NGL pipeline, which will have a capacity of 400,000 barrels per day (b/d) to transport liquids from the Permian Basin to North Texas. From there, it will connect to Targa's Grand Prix NGL pipeline, which has a capacity of 550,000 b/d, continuing the flow to Mont Belvieu, Texas. The Daytona pipeline can be expanded to handle 600,000 b/d by adding pumps. According to the company's first-quarter 2024 earnings call, they expect the pipeline to be operational by the fourth quarter of 2024.

Crude Production and Natural Gas Pipelines

The U.S. Energy Information Administration (EIA) projects that crude oil production in the Permian Basin will average around 6.3 million barrels per day (b/d) in 2024, reflecting an increase of nearly 8% compared to 2023. Meanwhile, Enverus Intelligence Research Inc. forecasts that undrilled Permian well inventory could add roughly 2 million b/d of incremental output by 2030.

However, along with the crude oil comes significant amounts of associated gas. Some of this gas is used locally, while some is transported to the Gulf Coast for conversion into LNG or petrochemicals, or electricity generation. Other portions are piped to the western U.S. and Mexico for similar uses.

As production ramps up, so does the need for transportation infrastructure to move the gas out of the region. When transportation becomes constrained, prices tend to drop because producers can't get their product to market, regardless of how low they price it. This situation could eventually force producers to cut back on crude production, even if there’s profit to be made. That’s where the need for new or expanded pipelines comes in.

WhiteWater Midstream LLC, MPLX LP, and Devon Energy Corp. are set to start service on their 2.5-bcfd Matterhorn Express natural gas pipeline in the third quarter of 2024. This 580-mile, 42-inch diameter pipeline will transport gas from the Waha hub to the Katy area near Houston.

WhiteWater is planning a 193-mile Blackfin pipeline that will run from Colorado County, Texas, at the edge of the Eagle Ford shale, to Jasper County in East Texas, just north of Beaumont and Port Arthur, close to the Louisiana border. Approved by the Railroad Commission of Texas in March 2023, this project will act as a 3.5-bcfd extension of the Matterhorn Express, increasing delivery options out of the Katy area. WhiteWater expects to begin construction in the third quarter of 2024, with the pipeline scheduled to be operational by the fourth quarter of 2025.

Energy Transfer Partners LP’s Warrior pipeline, which is designed to transport 1.5-2 bcfd of natural gas, is currently 25% subscribed. The project involves constructing about 260 miles of new pipeline between the Midland Basin and the Dallas-Fort Worth area, using existing infrastructure and loops to complete the route to the Louisiana Gulf Coast. During Energy Transfer’s first-quarter 2024 earnings call, co-CEO and CFO Tom Long mentioned that the industry shows strong interest in another pipeline by mid- to late 2026. He expressed optimism that the Warrior pipeline could be the next major pipeline to emerge from West Texas, noting that a final investment decision would need to be made by late third or early fourth quarter of 2024 to meet an end-2026 operational target.

In March of last year, the Railroad Commission of Texas also approved Targa Resources Corp.’s 562-mile Apex pipeline, which is set to deliver gas directly from Midland County to Jefferson County, Texas, near Sabine Pass. This 42-inch diameter pipeline is expected to carry approximately 2 bcfd by 2026. However, during a recent earnings call, Targa indicated that while it is continuing to develop the Apex pipeline, the company is also exploring other transportation options.

Earlier, the U.S. Federal Energy Regulatory Commission (FERC) granted ONEOK Inc. a Presidential Permit to construct and operate the Saguaro Connector natural gas pipeline crossing into Mexico from Hudspeth County, Texas. The proposed Saguaro Connector, with a capacity of 2.8 bcfd, will use 155 miles of 48-inch pipeline to transport Permian Basin gas from ONEOK’s existing WesTex intrastate pipeline, which has a capacity of 777 million cubic feet per day (MMcfd), and other sources to Mexico by 2026. On the Mexican side of the border, another pipeline will carry the gas to the west coast for liquefaction and export.

Kinder Morgan is considering further expanding its Gulf Coast Express pipeline, a 500-mile, 2-bcfd pipeline that runs from the Permian Basin to the Agua Dulce hub near Corpus Christi, Texas. The company completed a 570-MMcfd expansion of this system in December 2023 and is now eyeing another expansion, potentially coming online between 2027 and 2028.

Moss Lake Partners LP is planning to break ground on its DeLa Express pipeline in June 2026, aiming for a July 2028 operational start. This 42-inch diameter, 690-mile pipeline will supply 2 bcfd of natural gas from the Texas Permian Basin directly to Calcasieu Parish, Louisiana. The pipeline will serve various markets, including LNG plants, fractionators, and Moss Lake’s own NGL export project, Hackberry NGL. Moss Lake Partners requested FERC approval in April 2024 to begin the pre-filing review process for this project.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

U.S. Oil and Gas Drilling 2023-2024 Report: Rigs, Onshore, Offshore Activity, Biggest Companies

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R249_Blog_ U.S. Oil and Gas Drilling 2023-2024 Report_ Rigs, Onshore, Offshore Activity, Biggest Companies.png)

In January 2024, the United States saw a mix of ups and downs in the number of active drilling rigs across its major oil shale regions and states. Starting with the shale regions, the Permian Basin led with a slight increase, reaching 310 rigs, which is 3 more than in December. The Eagle Ford in East Texas held steady with 54 rigs, unchanged from the previous month. Meanwhile, both the Haynesville and Anadarko regions saw a decrease by 2 rigs each, landing at 42 rigs. The Niobrara faced a larger drop, losing 4 rigs to settle at 27. On a brighter note, the Williston Basin and the Appalachian region saw increases of 2 and 1 rigs, respectively, resulting in counts of 34 and 41 rigs.

Energy Transfer LP Races to Carry Permian Basin Gas to Gulf Coast Hubs

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Energy-Transfer-LP-Races-to-Carry-Permian-Basin-Gas-to-Gulf-Coast-Hubs.png)

The ever-increasing demand for natural gas exports from the Gulf Coast started a race to further develop Permian Basin. Various companies, including Kinder Morgan and MPLX, are among those looking at building new pipelines in the region due to the demand spike. But Energy Transfer seems to edge past them into the lead since its project strikes as the most economical option for the basin outside of capacity expansions on existing pipelines and could essentially add 1.5-2 Bcf/d of transport capacity with just 260 miles of new pipe.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/310_Blog_Massive Shutdown in U.S. Gulf of Mexico as Tropical Storm Francine Approaches .jpg)

A significant portion of the U.S. Gulf of Mexico's oil and natural gas production has come to a halt as Tropical Storm Francine barrels toward Louisiana, threatening the region's crucial energy infrastructure. In what is shaping up to be one of the most impactful events for U.S. energy this year, approximately 24% of crude oil production and 26% of natural gas output in the Gulf are now offline, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE). Francine, with winds reaching 65 mph (100 kph), is currently situated 380 miles (610 km) southwest of Morgan City, Louisiana, and is expected to strengthen into a hurricane by the end of the day. The storm's trajectory is causing widespread disruptions to offshore operations in the Gulf, which plays a vital role in the country’s energy supply.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/309_Blog_Why This Matters Diamondback and Endeavor’s 26 Billion Merger Creates a Permian Titan.jpg)

What happens when two giants merge to form an oil empire? Diamondback Energy has just completed a massive $26 billion merger with Endeavor Energy Resources, following months of review by the Federal Trade Commission (FTC). The outcome? A powerful new player in the oil industry, poised to transform production in the Permian Basin, one of the richest shale regions in the world. Analysts are calling this merger a game-changer, as Diamondback and Endeavor now control a vast expanse of oil-rich land, referred to as the "last and best oil sandbox" for its potential to maximize production using advanced technology.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/308_Blog_New ERA U.S. Allocates 7.3 Billion for Rural Clean Energy Initiatives.jpg)

The United States government has announced a significant investment of $7.3 billion from the 2022 Inflation Reduction Act (IRA) to support clean energy initiatives led by rural electric cooperatives. These projects aim to reduce energy costs, enhance reliability, and promote sustainability for rural communities, where energy costs tend to be higher than in urban areas. This investment marks a substantial effort toward decarbonizing rural America while supporting job creation and infrastructure improvements.