Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Haynesville Shale's 2022-2023 Performance Overview, What Happened, Trends

03/14/2024

The Haynesville Shale play, located in northwestern Louisiana and eastern Texas, was recognized in March 2008. Petrohawk Energy Corp. and Chesapeake Energy Corp. had leased acreages in Louisiana, bringing fame to the region.

The Haynesville Shale is crucial for meeting the rising demand for LNG exports from the Gulf Coast because of its location. It's expected that Haynesville will contribute about 13 Bcf/d to the overall growth in U.S. gas demand by 2030. However, drilling in Haynesville is more expensive and challenging due to the depth of its wells, especially when compared to areas like the Marcellus Shale.

2022

After reaching a record-high production in 2021, the Haynesville Shale experienced a quieter 2022, with limited deal activity and a focus that seemed to shift more towards LNG exports than production itself. However, there were signs that the third-largest producing gas shale in the U.S. was gearing up for a strong 2023, provided commodity prices remained stable.

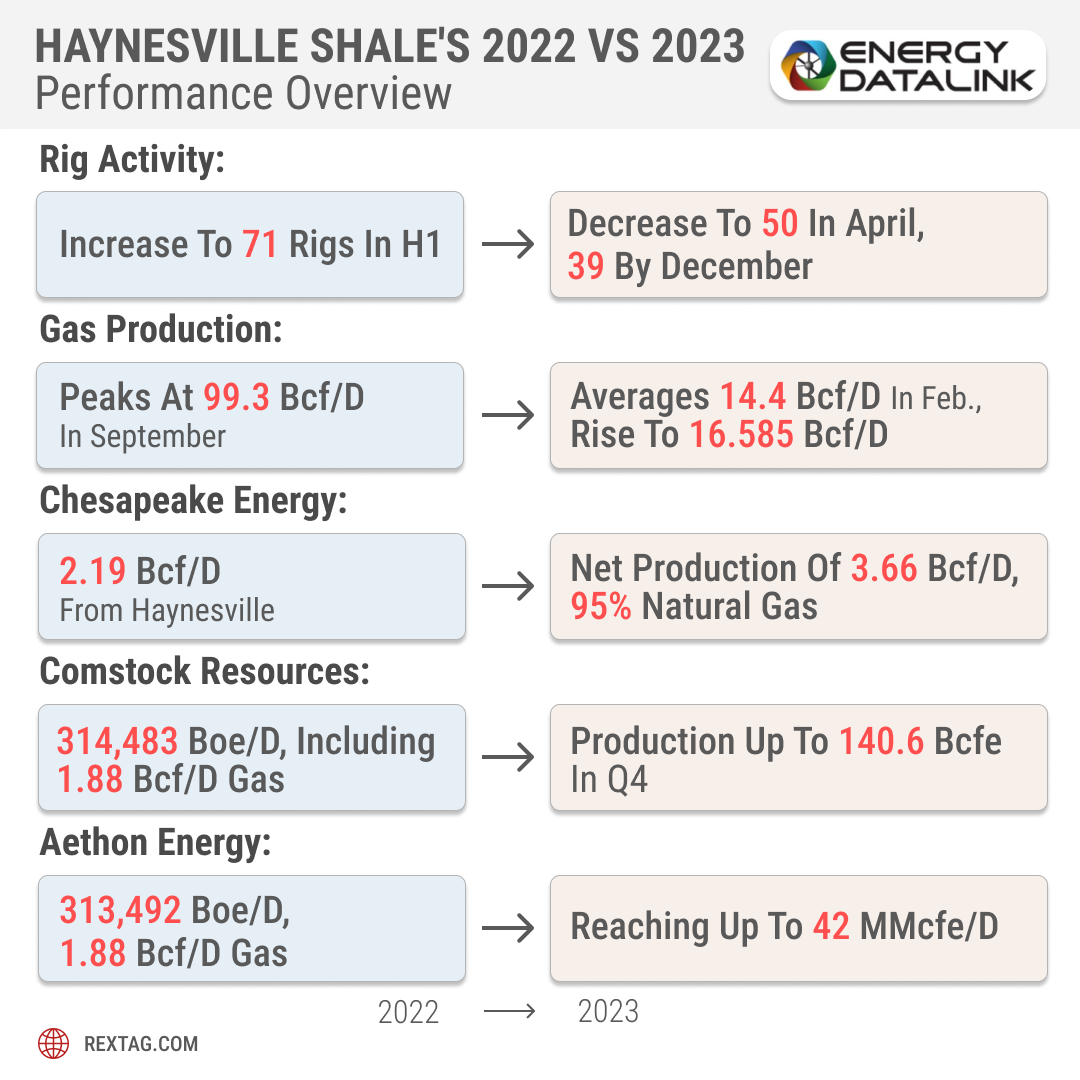

Rig activity in Haynesville saw a 54% increase from an average count of 46 in 2021 to 71 in the first half of 2022, as reported by J.P. Morgan's September “JPM Natural Gas Reservoir” report.

Rextag consistently monitors and compiles data on Natural Gas. Discover detailed insights in our exclusive ‘American Gas Data & Map Book’.

Gas pipeline flows exceeded expectations, reaching record highs of nearly 99.3 Bcf/d in September, with MTD gas production estimated at 98.7 Bcf/d. This was in comparison to the August average of 97.7 Bcf/d and the September 2021 average of 92.7 Bcf/d.

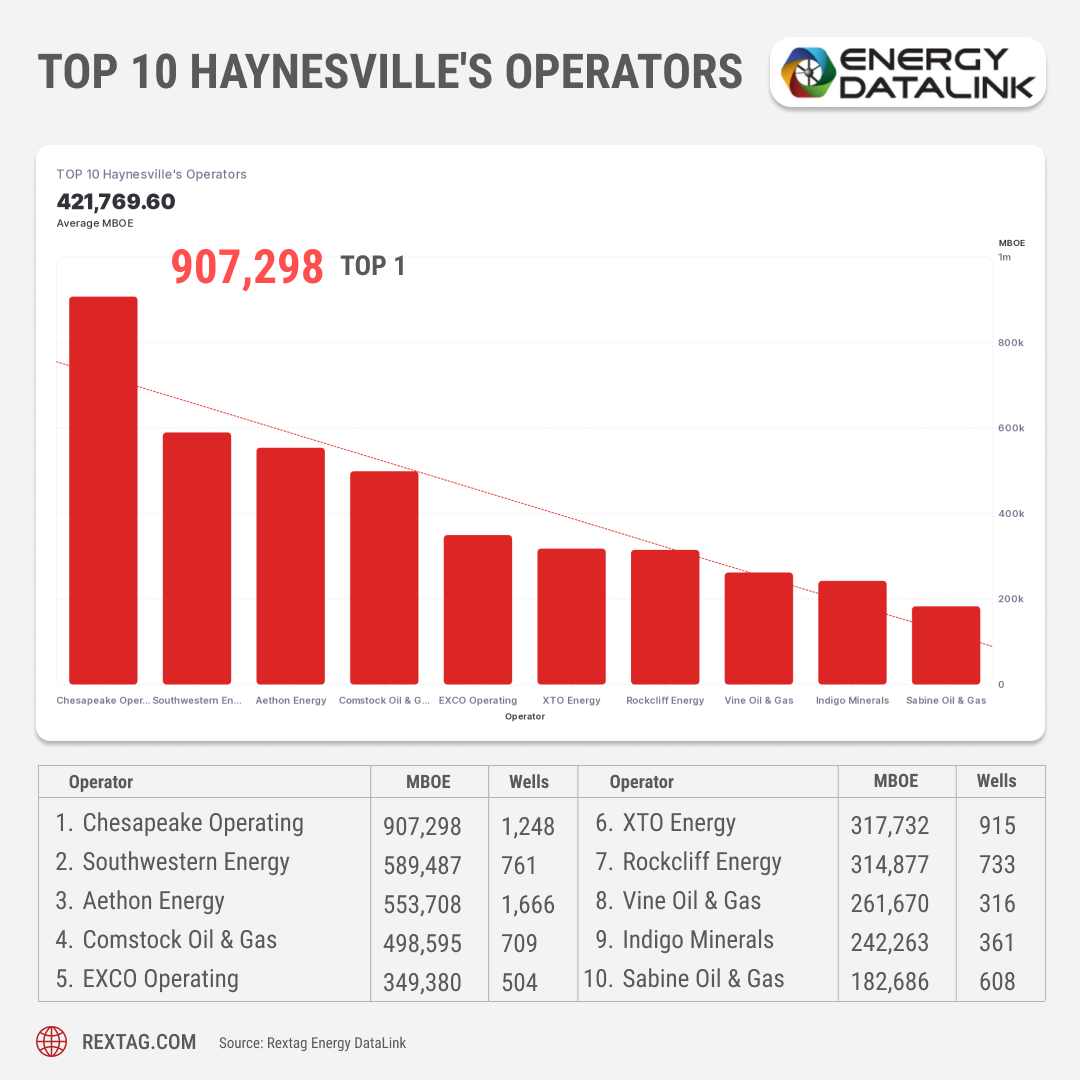

Top basin performers such as Chesapeake Energy, Southwestern Energy, Comstock Resources, Aethon Energy, and Rockcliff Energy II produced a combined total of 1.53 MMboe/d, 83 bbl/d of oil, and 9.2 Bcf/d of gas in the first half of 2022.

Chesapeake, one of the first companies to operate in the basin, was Haynesville’s largest producer in the first half. The company reported producing 1.23 MMboe/d during the period, with 365,766 boe/d coming from its Haynesville operations, which included 2.19 Bcf/d of the total 6.98 Bcf/d produced from the Haynesville.

Despite producing 89,862 bbl/d of oil in the first half of the year, none of Chesapeake's oil production originated from Haynesville. The focus in the latter half of the year shifted towards expanding Chesapeake’s midstream capacity, with a commitment to supply 700 MMcf/d to a new pipeline to be built by Momentum from the heart of the Haynesville play down to Gilles.

Chesapeake's production from Haynesville stood at 334,716 boe/d in the first half of 2022, against the total 887,668 boe/d produced by the company across all its assets. It also produced 2 Bcf/d from its combined Haynesville and Appalachian assets, out of a total reported 5.19 Bcf/d.

With assets across northern Louisiana and eastern Texas, Comstock emerged as the third most productive Haynesville operator, running eight rigs. The company's production in Haynesville reached 314,483 boe/d, 28 bbl/d of oil, and 1.88 Bcf/d of gas in the first half of 2022.

As the largest private producer in Haynesville, Aethon reported producing 313,492 boe/d from the basin, out of its total 330,601 boe/d. This included 19 bbl/d of oil and 1.88 Bcf/d of natural gas, from its total 1.98 Bcf/d production.

Rockcliff, the second private company to stand out in Haynesville, had a total production of 205,997 boe/d in the basin during the first half of the year. Of this, 36 bbl/d of oil and 1.24 Bcf/d of natural gas came from the East Texas basin, part of its 1.32 Bcf/d total natural gas production.

2023

- Natural Gas Production

Haynesville shale's dry natural gas production reached new highs in early 2023, averaging 14.4 billion cubic feet per day (Bcf/d) in February, marking a 9% increase from the annual average of 13.2 Bcf/d in 2022. This trend continued into March 2023, with production further increasing to an average of 14.5 Bcf/d, 10% higher than the 2022 annual average (13.2 Bcf/d). Haynesville thus accounted for about 14% of all U.S. dry natural gas production.

The production continued to rise, with expectations to increase by 145 MMcf/d monthly to 16.585 Bcf/d.

- Rig Activity

The rig count in Haynesville experienced a slight decline in 2023 due to lower gas prices. In April 2023, the rig count saw a minor reduction, totaling 50 active rigs in the region. This was a significant change from the previous year, where an average of 65 rigs were operational in 2022, a 43% increase from 2021. The number of active rigs in the region was 39 as of December 7, 2023, marking a 41% decrease year-over-year.

- Pipeline Developments

Several pipeline projects were underway or completed in 2023 to enhance the takeaway capacity from Haynesville to meet the rising demand, especially from LNG export facilities on the Gulf Coast. Notable projects included the early mechanical completion of Phase 2 of the DT Midstream LEAP expansion, the ongoing development of the Louisiana Energy Gateway (LEG) by Williams, and the Enterprise Products’ expansion of the Acadian Haynesville extension.

For instance, the Gillis Access project by TC Energy, sanctioned with a $400 million investment, is expected to connect increasing supply from Haynesville to Louisiana markets, especially the fast-growing Louisiana LNG export market, with completion anticipated in 2024.

For the full year 2023, Chesapeake reported a net production of approximately 3.66 Bcfd, with about 95% being natural gas. This production utilized an average of 11 rigs to drill 193 wells and place 166 wells on production, underscoring the company's operational efficiency and focus on capital discipline and free cash flow generation in a challenging commodity price environment.

Comparing this to 2022, when top basin performers including Chesapeake Energy produced a combined total of 1.53 MMboe/d, 83 bbl/d of oil, and 9.2 Bcf/d of gas in the first half of the year, it's clear that Chesapeake has continued to adapt its strategies to maintain a strong operational performance.

The company plans to remove one drilling rig in Haynesville and one in Marcellus in March and around the middle of the year, respectively. They will also remove a fracking team in each area in March and keep this level of operation until the end of the year. By delaying the start of new wells and the completion of drilling, the company will save money and be ready to increase production quickly when customers need more. They aim to drill 95 to 115 wells and use 30 to 40 wells in 2024.

In February 2024, Chesapeake announced it had made its first long-term agreements to buy liquefied natural gas (LNG). They will buy about 0.5 million metric tons per year of LNG from Delfin LNG, with prices linked to the Henry Hub index, starting in 2028.

In 2022, Southwestern Energy focused on strengthening its financial position, repaying over $1 billion in debt and producing 1.7 Tcfe, with a net income of $1.8 billion and $2.2 billion in investments. In contrast, 2023 saw dynamic growth in production starting at 411 Bcfe in Q1, increasing to 425 Bcfe by Q3, with a total investment decreasing from $665 million to $454 million through the quarters. This underscores the company's strategic investment and operational efficiency, particularly in the Appalachia and Haynesville regions.

Comstock Resources was a top Haynesville producer in 2022, operating eight rigs with a production rate of 314,483 boe/d, including 28 bbl/d of oil and 1.88 Bcf/d of gas. By 2023, the company enhanced its operational and financial performance, with Q3 revenues at $376.7 million and production of 130.6 Bcfe, and Q4 seeing revenues increase to $410.6 million and production to 140.6 Bcfe. This growth culminated in a Q4 net income of $108.4 million.

Aethon Energy, the largest private producer in Haynesville, for 2022 produced 313,492 boe/d from the basin, with 1.88 Bcf/d of this being natural gas. By 2023, Aethon expanded its operations into the Bossier formation, achieving production rates as high as 42 MMcfe/d from a single well.

Rockcliff Energy II, based in Texas, was acquired by TG Natural Resources for $2.7 billion in December 2023. Prior to the acquisition, Rockcliff maintained operations in five Texas counties with over 200,000 net acres, achieving a gross operated natural gas production exceeding 1.3 billion cubic feet per day. The company has shown significant growth since its inception by Quantum Energy Partners in 2015, increasing its production from approximately 100 MMcf/d in 2017 to over 1.3 Bcf/d in 2023.

Final Thoughts

From 2022 to 2023, Haynesville Shale saw big changes. In 2022, after a year of high gas production, activity slowed down a bit, but the area was getting ready for more work, especially for LNG (liquid natural gas) exports. The number of rigs, which are machines used for drilling, increased by 54% from an average of 46 in 2021 to 71 in the first half of 2022. This showed that companies were preparing to produce more gas.

By 2023, this preparation paid off. Gas production jumped, reaching 14.4 billion cubic feet per day (Bcf/d) on average in early 2023. This was a big rise from the average production in 2022. The focus on LNG became clearer when Chesapeake Energy, a big company in the area, announced plans to buy LNG starting in 2028. This showed that Haynesville was becoming more important for supplying gas for LNG exports.

Investments in pipelines and other infrastructure also grew, making it easier to send gas to places where it could be exported as LNG. This included big projects to expand the capacity of pipelines, which are pipes that carry gas over long distances.

Even though more gas was being produced, the number of rigs in 2023 went down compared to 2022 because gas prices were lower, and companies wanted to be smart about how much they spent on drilling. They focused on using fewer rigs more efficiently instead of just adding more.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

WhiteHawk Energy Expands Portfolio with $54 Million Marcellus Shale Natural Gas Asset Purchase

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/205Blog_WhiteHawk’s Marcellus Shale Map (1).png)

WhiteHawk Energy has recently completed a significant acquisition in the Marcellus Shale, investing $54 million. This deal has effectively doubled their mineral and royalty ownership in the Marcellus Shale, particularly in Greene and Washington counties in Pennsylvania. This region is noted for its high-quality natural gas reserves. WhiteHawk’s Marcellus assets now encompass approximately 475,000 gross unit acres, featuring production from about 1,315 horizontal shale wells. In addition to this, they own interests in 72 wells-in-progress, 64 permitted wells, and nearly 900 undeveloped Marcellus locations. This acquisition is expected to double WhiteHawk's net revenue interest in each well within its Marcellus holdings.

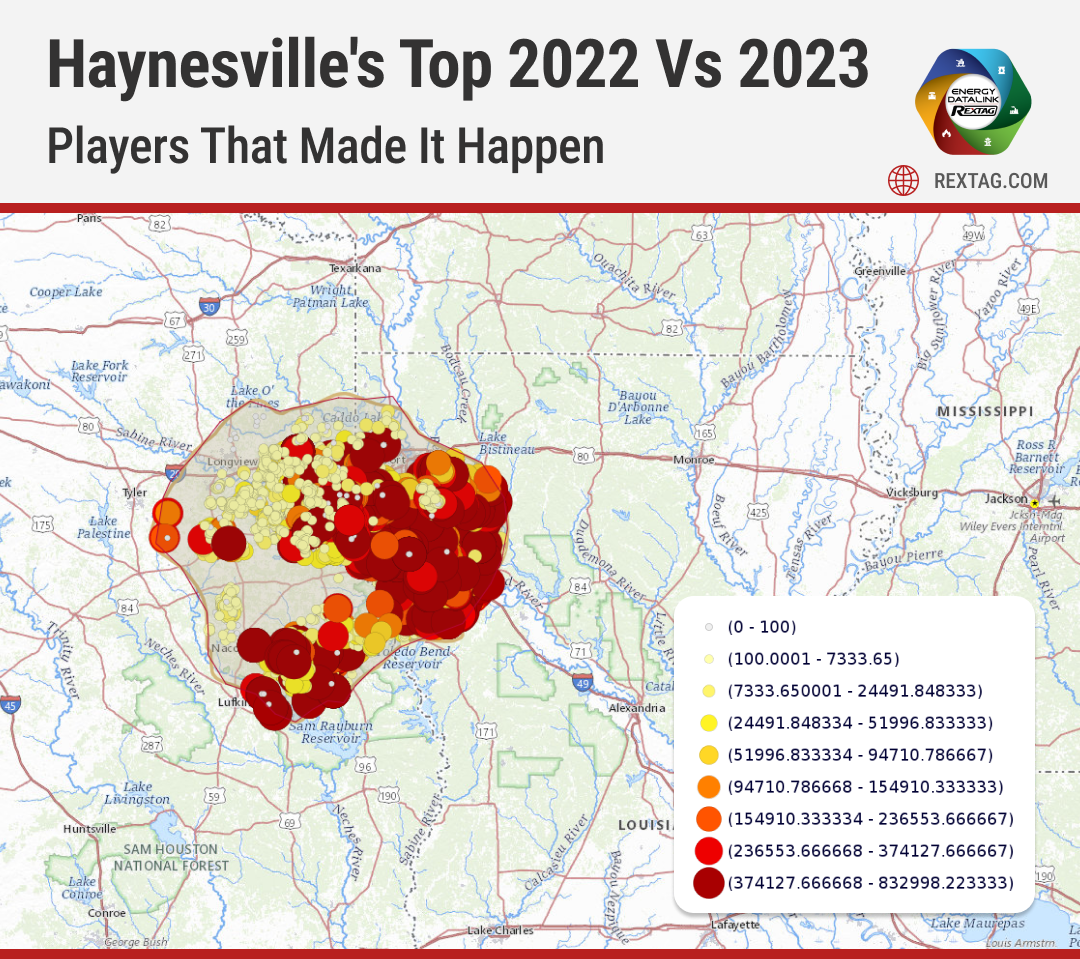

Haynesville's Top 2022 Players That Made It Happen

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/112Blog_Top_5_Haynesville_2022_Producers_12_2022 (1).png)

After reaching record-high production in 2021, the Haynesville Shale seemed to have a quiet 2022, with a smattering of deal activity and attention seemingly focused more on LNG exports than production. Meanwhile, the indications are that the third-largest producing gas shale in the U.S. is growing up for a robust 2023 if commodity prices stand still. Top basin performers Chesapeake Energy, Southwestern Energy, Comstock Resources, Aethon Energy, and Rockcliff Energy II produced a combined total of 1.53 MMboe/d, 83 bbl/d of oil, and 9.2 Bcf/d of gas in the first half of 2022.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?