Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Decades of free inventory from one deal: Vermilion Energy buys Leucrotta Exploration for $477 million

04/07/2022

As part of its effort to expand its Montney Shale play, Vermilion Energy Inc. recently acquired Leucrotta Exploration Inc. for a net cash purchase price of CA$477 million.

Dion Hatcher, Vermillion's president, believes the Leucrotta acquisition is integral to the company's strategic plan due to the asset's scalability and expected availability of high-value Tier 1 drilling inventory for at least the next 20 years.

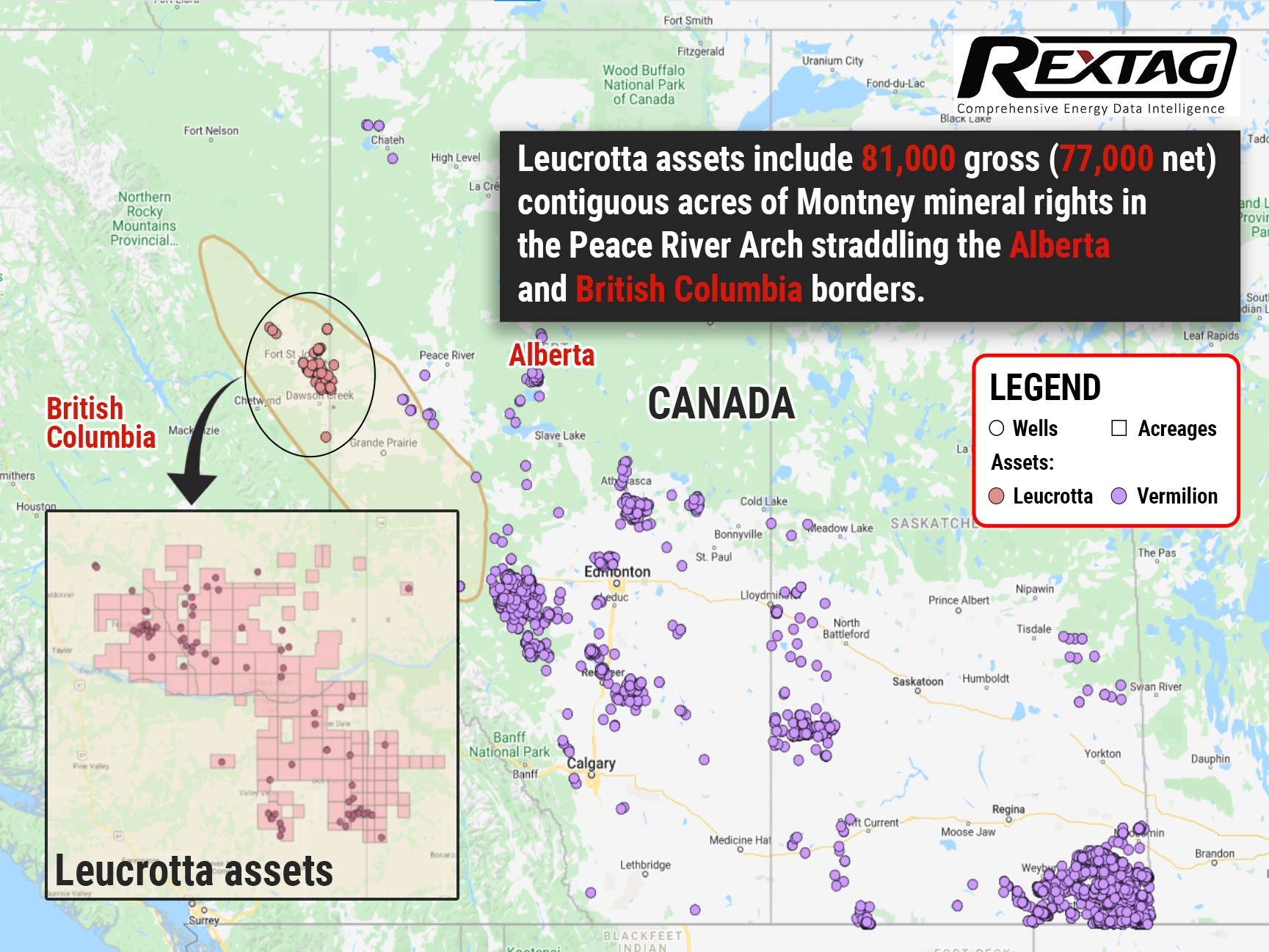

Located in the Mica region of Northeast British Columbia and Northwestern Alberta, Leucrotta is a publicly-traded company focused on Montney hydrocarbon exploration. Leucrotta's acquisition by Vermilion follows its agreement to purchase Equinor Energy Ireland Ltd. last November for CA$556 million (US$434 million).

In addition to adding Equinor Energy Ireland to Vermilion's gas holdings, this acquisition will broaden the company's European gas exposure while also helping it to reduce debt faster.

After completing both deals, Vermillion aims to reduce debt by $1 billion by the end of the year, three years ahead of schedule.

Vermilion anticipates being debt-free by end-of-2023 at current strip prices. As for the company's near-term strategic objectives, Top management also plans to complete them without issuing any more shares, which maximizes free cash flow for shareholders and prevents dilution.

It is anticipated that Leucrotta's acquisition will close by the end of May. While closing of the Corrib acquisition is scheduled for the second half of 2022.

According to the Leucrotta acquisition agreement, Vermilion will pay CA$1.73 per share in cash for all of the company's issued and outstanding shares.

Mica is the primary Leucrotta asset, consisting of 81,000 gross (77,000 net) contiguous acres of Montney mineral rights which border both Alberta and British Columbia. The asset is expected to produce approximately 13,000 barrels of oil equivalent per day in 2023, with a plateau production level of 28,000 barrels per day anticipated over the next few years.

As of today, Vermilion has identified 275 high-quality, high-return, low-risk multi-zone drilling prospects. Top management believes, these prospects represent 20 or more years of low-risk, self-funding, high-deliverability drilling.

Assuming the anticipated May closing date, Vermilion is increasing its capital budget for E&D in 2022 to $500 million and increasing guidance for production from 86,000 to 88,000 boe/d to take into account the Leucrotta acquisition.

The acquisition deal also involves the transfer of a portion of the Leucrotta land base and approximately CA$43.5 million of cash to a new company, which will be managed by the existing Leucrotta team.

Without the right tools, it is impossible to visualize such large fluctuations in the market.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Canadian Assets on Sale: Energy Transfer Sells Gas Processing Bussines to Pembina-KKR for $1.3 Billion

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/60Blog_Energy_Transfer's_Canadian_Assets_2022.png)

Under the agreement, Energy Transfer will sell its 51% interest in Energy Transfer Canada to the Pembina-KKR joint venture, for more than CA$1.6 billion (US$1.3 billion) including debt and preferred equity. KKR's funds already own the remaining stake. TC’s assets include 6 natural gas processing plants with a combined operating capacity of 1.29 Bcf/d and an 848-mile naturalgas gathering and transportation network in the Western Canadian Sedimentary (WCS) basin. While this process is underway, Pembina and KKR will combine their Western Canadian natural gas processing assets into a single, new joint venture entity — Newco, owned 60% by Pembina and 40% by KKR. This new entity is expected to have a natural gas processing capacity of about 5 Bcf/d or about 16% of Western Canada’s total processing capacity.

2023 Closes with a Wave of Deals: Canada to Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/217Blog_Athabasca Oil and Cenovus Energy are joining to form Duvernay Energy.png)

-Crescent Point Energy finalized its $1.9 billion purchase of Hammerhead Energy to expand operations in Alberta's Montney Shale -Two Canadian companies merged to increase their presence in Alberta's Kaybob Duvernay area -Ring Energy completed acquisition in the Permian Basin

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?