Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Bison Gas Gathering System Sold: $40M Cash Paid By Summit Midstream to Steel Reef

10/25/2022

Steel Reef acquires Summit Midstream’s Bison Gas gathering system in North Dakota for $40 million in cash as part of Houston-based Summit’s plans to streamline its portfolio.

According to a release on September 19, with the sale of Bison Midstream, Summit’s focus in the Williston Basin will be on increasing its crude oil and produced water gathering systems mainly situated in Williams and Divide Counties, North Dakota.

The Bison agreement follows the sale of Summit’s Lane gathering and processing system in the Permian Basin to Matador Resources Co. in June for $75 million. The merger of the divestitures creates additional financial flexibility to reinvest in more strategic scale-building opportunities across Summit’s footprint.

Summit Midstream Partners LP concentrates on developing, possessing, and managing midstream energy infrastructure assets that are strategically situated in the core producing areas of unconventional resource basins, mainly shale formations, in the continental U.S. The company’s portfolio is broken down into four sections: the Barnett, Northeast, Permian, and Rockies.

After the sale of the company’s Bison gas gathering system, Summit will still possess the Polar and Divide system in the Williston Basin, which has more than 295 miles of crude oil and produced water pipelines, spanning throughout the central and western parts of Williams and Divide counties in North Dakota, from the Missouri River to the Canadian border.

Summit Midstream is interested in the status of customer development activity in central Williams County and pro forma for the transaction and anticipates over 50 new wells behind our liquids system in 2023.

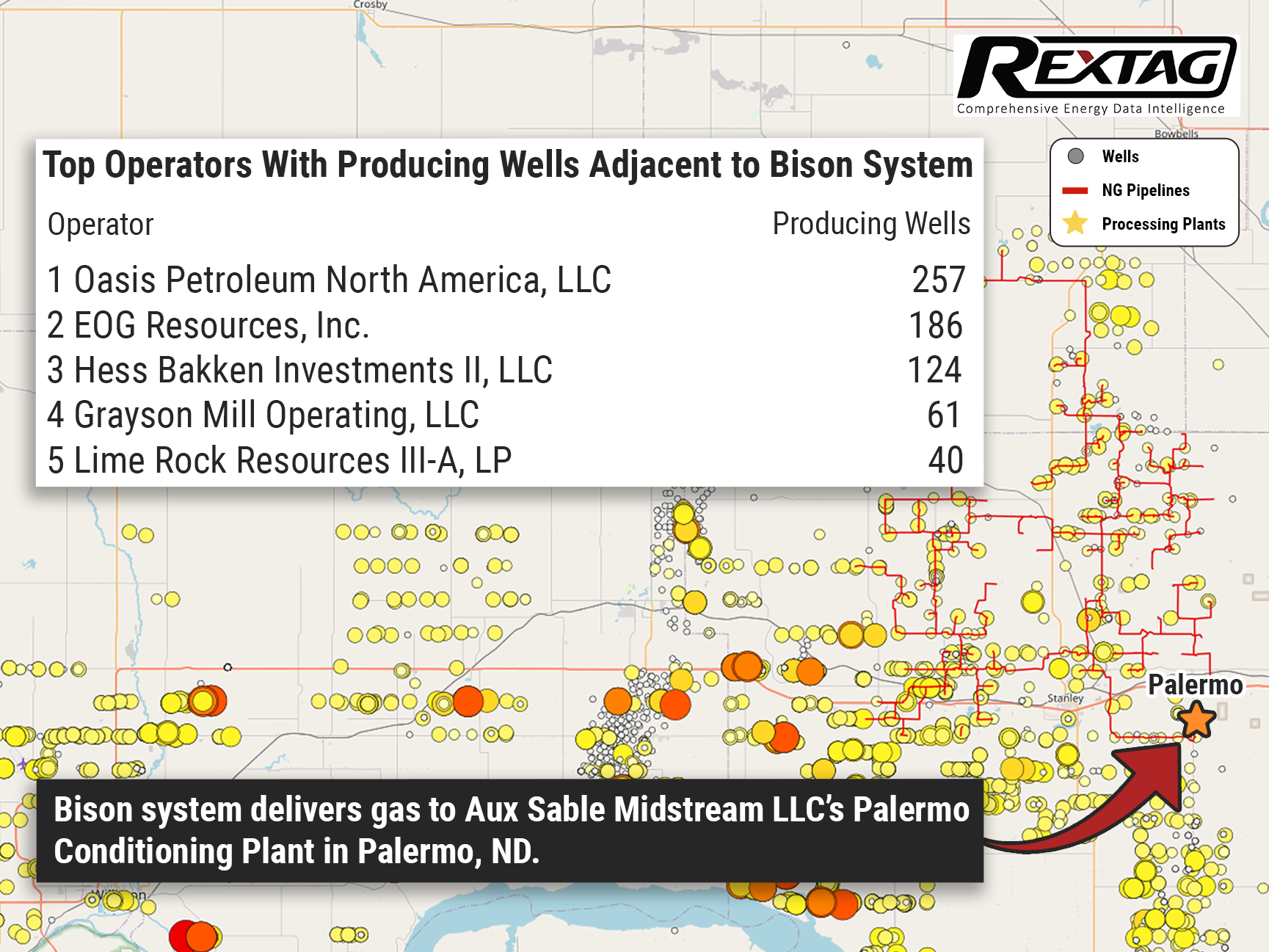

The Bison gas gathering system, established in Mountrail and Burke counties in northwestern North Dakota, was purchased by Steel Reef Infrastructure Corp., an integrated owner, and operator of associated gas capture, gathering, and processing assets in North Dakota and Saskatchewan.

Bison gathers, compresses, and treats associated natural gas in the crude oil stream produced from the Bakken and Three Forks shale formations. According to the Summit release, a large U.S. independent crude oil and natural gas company and Chord Energy Corp. are Bison Midstream’s key customers.

Natural gas gathered on the Bison system is conveyed to Aux Sable Midstream LLC’s Palermo Conditioning Plant in Palermo, North Dakota. Then the gas is transferred to downstream pipelines serving Aux Sable's 2.1 Bcf/d natural gas processing plant in Channahon, Illinois.

Pro forma for the Bison transaction, Summit will have about $90 million drawn on its $400 million ABL credit facility, resulting in over $300 million of available liquidity, according to Deneke. The company continues to anticipate to trend toward the high end of our 2022 Adjusted EBITDA guidance range of $205 million to $220 million.

Locke Lord LLP served as the legal adviser to Summit and Bracewell LLP was the legal adviser to Steel Reef for the Bison transaction.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

The Deal between TC Energy and Mexican Utility is Concluded to Build $4.5 Billion Gas Pipeline

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/90Blog_SouthEast_Gateway_Announced_2022_09.png)

TC Energy Corp. had reached a deal with a Mexican state utility to build a $4.5 billion natural gas pipeline, according to a company release on Aug. 4. The natural gas to Mexico's central and southeast regions will be furnished by the 1.3 bcfd offshore Southeast Gateway Pipeline, the Canadian pipeline operator said. Due to the most serious trade spat with #Mexico over the United States-Mexico-Canada Agreement, Canada and the United States made the deal with Comisión Federalde Electricidad (CFE). TC Energy and CFE in conjunction with the alliance also took the final investment decision (FID) on the 715-km Southeast Gateway. The pipeline will serve southeast Mexico, starting onshore in Tuxpan, Veracruz, then proceeding offshore, making landfall at Coatzacoalcos, Veracruz, and Dos Bocas, Tabasco.

Potential Deal for $5 Billion: Tug Hill and Quantum Energy Seek Sale

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/78Blog_THQ_Aappalachia's_wells_on_sale_2022_07.png)

Undisclosed industry sources said that THQ Appalachia I LLC (Tug Hill and Quantum Energy) is seeking a sale of the U.S. natural gas producer for more than $5 billion, including debt. Mainly operating in the Marshall and Wetzel counties in West Virginia, THQ Appalachia has net production of around 760 MMcf/d. Despite volatility in commodity markets which has made the valuation of energy producers tougher, THQ Appalachia is anticipating more than $5 billion due to the worth of its existing production and the possible value of its undeveloped acreage, the sources said on June 17. Additionally to purchasing THQ Appalachia, possible bidders in the sale process also have the opportunity to buy XcL Midstream, the pipeline firm that moves the company’s gas to market and has the same CEO as in Tug Hill. If the same buyer chooses to purchase XcL, the deal consideration will increase further. However, the anonymous sources admitted that the sale depends on the market conditions and is not guaranteed since Tug Hill and Quantum could ultimately decide to retain some or all of THQ Appalachia and XcL’s assets. Tug Hill and Quantum refused to comment on these statements and XcL did not respond to a comment request.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?