Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

$205 Million for Marcellus Assets Divested by Crestwood to Antero

10/18/2022

Antero Midstream Corp. bought Marcellus assets of Crestwood Equity Partners LP on September 12 for $205 million in cash, signing another sale of noncore assets by the Houston-based company.

Crestwood has strategically enhanced its asset portfolio through a series of A&D transactions for the previous 18 months to create a competitive scale in the Williston, Delaware, and Power River basins. The strategy covered acquisitions of Oasis Midstream Partners, Sendero Midstream, and Crestwood Permian Basin Holdings LLC (CPJV), which was a 50:50 joint venture of Crestwood and First Reserve.

This company release highlighted the confidence in the portfolio achieving the company’s long-term leverage ratio target of sub 3.5x in 2023 and showed the commitment to generating accretive unitholder returns and solidifying their financial flexibility for the future.

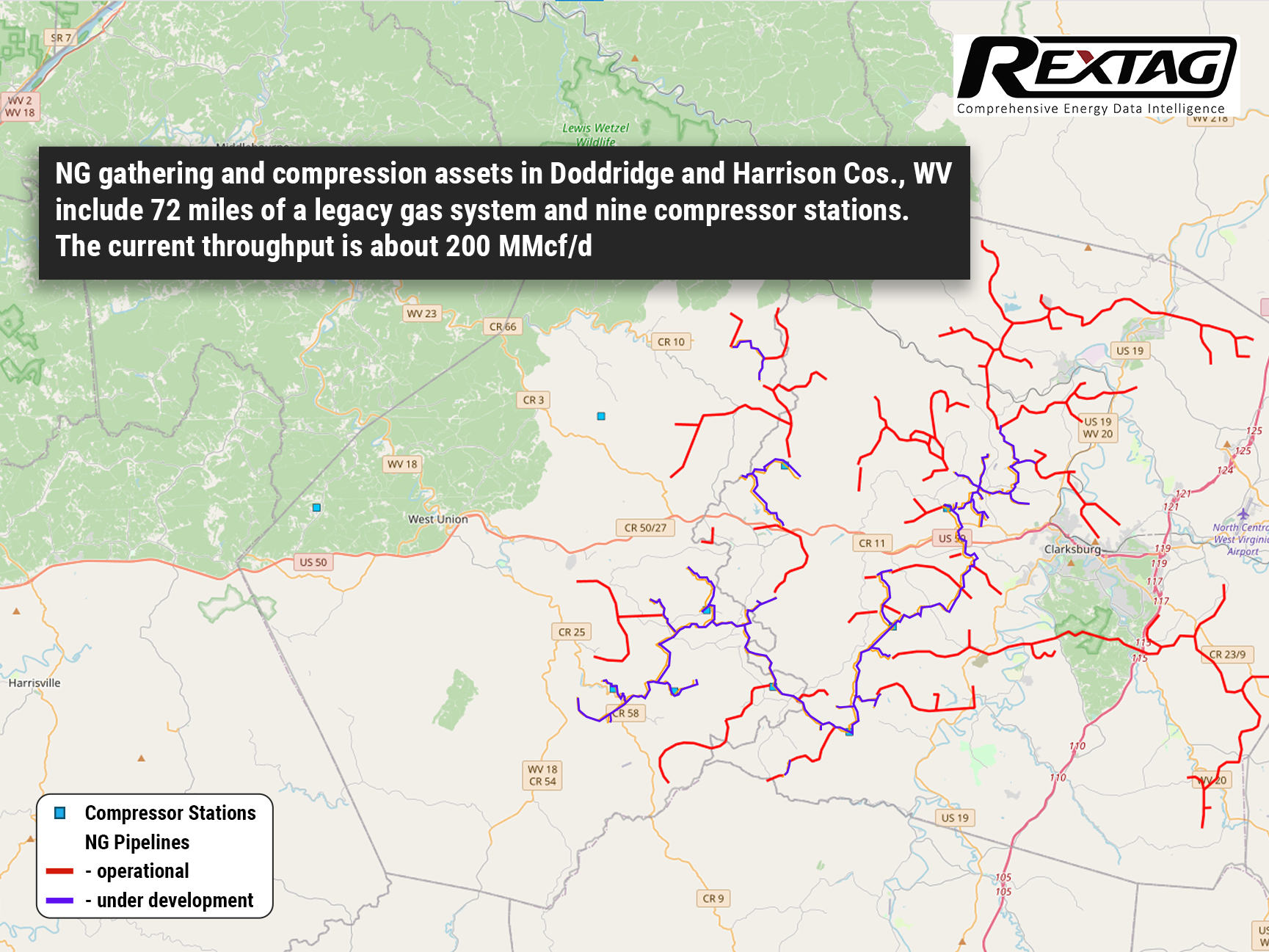

Crestwood’s Marcellus natural gas gathering and compression assets are based in West Virginia in Doddridge and Harrison counties. The assets consist of a legacy gas system that was purchased by Crestwood from Antero Resources Corp. in 2012 for $376.8 million.

Antero Resources established Antero Midstream in 2012 to service its rapidly growing natural gas and NGL production in the Appalachian Basin. The transaction on September 12 represents a bolt-on acquisition that is valued to be more than 10% accretive to free cash flow after dividends through 2026.

The assets to be bought cover 72 miles of dry gas gathering pipelines and nine compressor stations with about 700 MMcf/d of compression capacity. The current throughput on the system is approximately 200 MMcf/d, resulting in important available capacity for increase without major capital investment.

Crestwood said that the Marcellus assets have been impacted in recent years by Crestwood’s anchor producer concentrating development activity on the rich gas window of the southwest Marcellus Shale. For this reason, the assets have been on natural field decline since 2017 and are noncore to Crestwood’s long-term development strategy of growing as a leading midstream operator in the Williston, Delaware, and Power River basins.

The deal includes almost 425 undeveloped drilling locations and 120,000 gross dedicated acres from Antero Resources mainly in Harrison County. The acquisition is also anticipated to raise Antero Midstream’s compression capacity by 20% and gathering pipeline mileage by 15%.

The transaction is anticipated to close the fourth quarter and illustrates a multiple of over 7 times 2023E adjusted EBITDA. For Antero Midstream, the transaction multiple was at about 6x the next 12 months valued adjusted EBITDA, excluding synergies.

Crestwood aims to use the proceeds from the Marcellus sale to improve financial flexibility through a combination of debt reduction and opportunistic common unit repurchases.

Antero Midstream will finance the deal with borrowings under the company’s revolving credit facility.

Locke Lord LLP served as legal adviser to Crestwood. Vinson & Elkins LLP served as legal adviser to Antero Midstream.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Earthstone Expands Due to Acquisition of Titus’ Delaware

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/79Blog_Earthstone_Acquires_Titus_2022_07.png)

Earthstone Energy Inc., based in Texas, announced the transaction on June 28: the acquisition of Titus Oil&Gas which will raise production in the Delaware Basin by 26%. The $627 million acquisition fills the Permian Basin in Eddy and Lea counties, N.M. with 86 net locations on 7,900 net acres of leasehold, while it is not clear how much of the leasehold might be on federal acreage It is Earthstone’s seventh acquisition since 2021, a span that includes the closing of approximately $1.89 billion in acquisitions in the Permian Basin. The purchase of Titus Oil & Gas Production LLC and Titus Oil & Gas Production II LLC, privately held companies backed by NGP Energy Capital Management LLC, is estimated at $575 million in cash and it is the equivalent of $52 million in stock (3.9 million shares of its Class A common stock based on the June 24 closing price). Titus shared that its net production in June was 31,800 boe/d. The company had reserves of approximately 28.9 MMboe. Earthstone is sure its net production will increase, at the midpoint, by 20,500 boe/d (65% oil) in the fourth quarter.

Centennial, Colgate Merger Is Completed on Sep.1

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/87Blog_Permian_Resources_fromer_Centennial&Colgate_2022_09.png)

The completion of the merger between Centennial Resource Development Inc. and Colgate Energy Partners II LLC happened on Sept. 1, sealing the debut of Permian Resources Corp., which is considered the largest pure-play E&P company in the Delaware Basin. Permian Resources’ idea was to combine two successful E&P companies, creating a better, stronger, and more strategically compelling company. Centennial and Colgate announced an agreement to merge in May, denying rumors that Colgate, a privately held independent Midland-based company, had been seeking an IPO. The merger estimated Colgate at about $3.9 billion and consists of 269.3 million shares of Centennial stock, $525 million of cash, and the assumption of approximately $1.4 billion of Colgate’s outstanding net debt. Permian Resources, being the combined company, has a deep inventory of “high-quality” drilling locations on around 180,000 net acres the companies anticipate will provide more than $1 billion of free cash flow in 2023 at current strip prices, in accordance with the company release on Sept. 1.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?