According to Reuters, Chevron has recently made additional assets available for acquisition in both New Mexico and Texas.

As part of its strategy to streamline operations following significant shale acquisitions, Chevron is reportedly offering multiple oil and gas properties for sale in New Mexico and Texas. Marketing documents reviewed by Reuters reveal the company's intention to divest these assets.

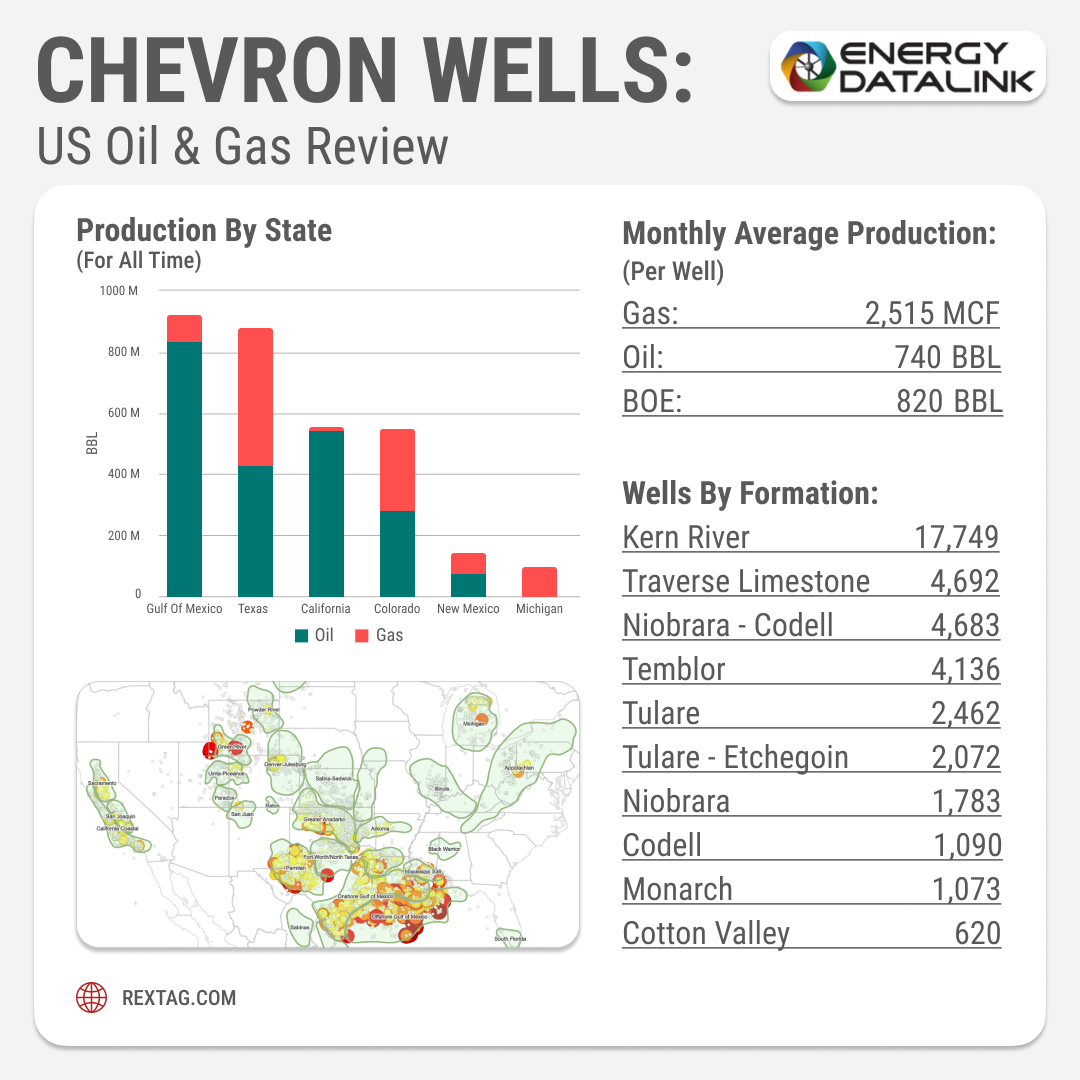

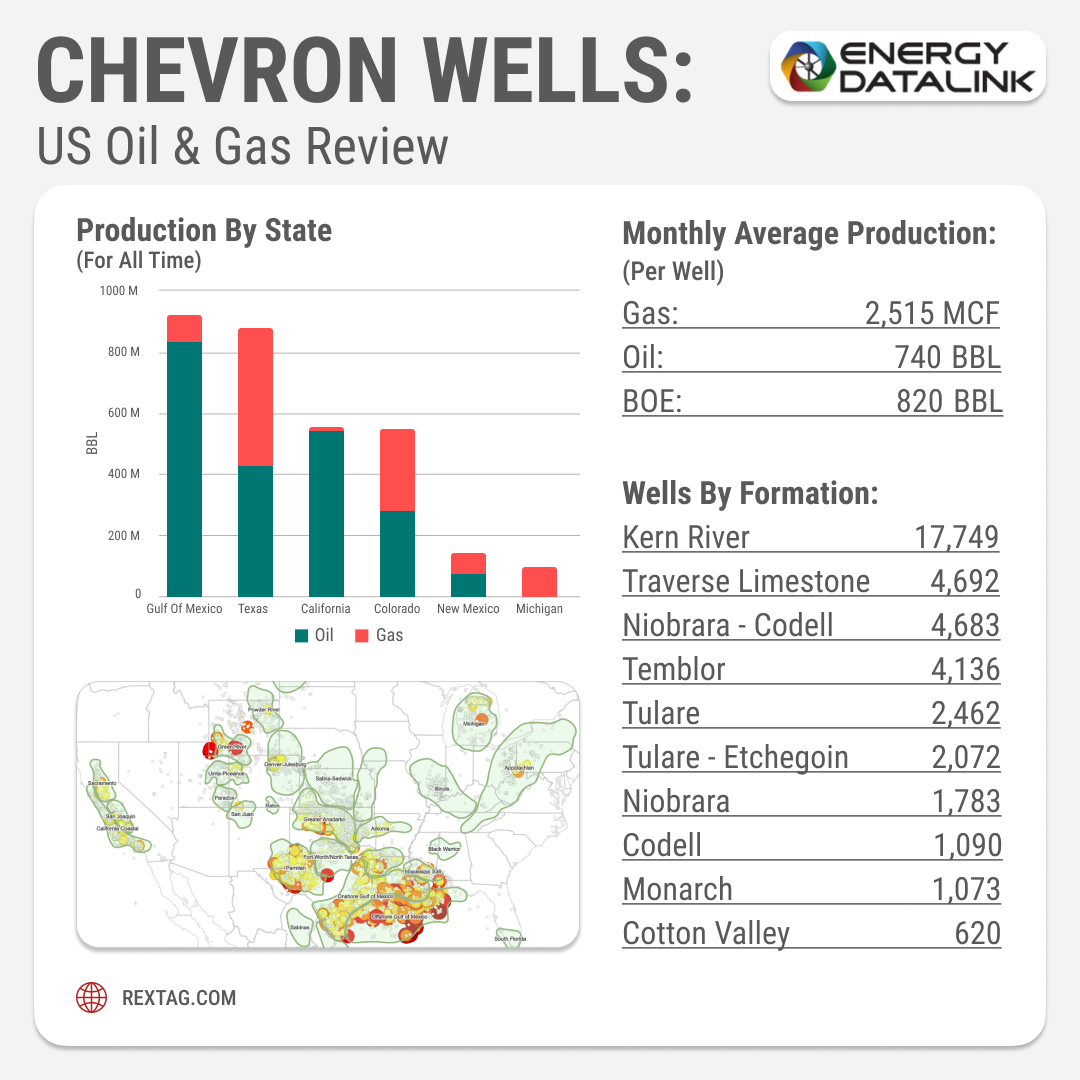

Despite its prominent position as the largest publicly-traded oil and gas producer and property owner with 2.2 million acres in the Permian Basin of West Texas and New Mexico, Chevron has been actively divesting properties in the region. This divestment aligns with Chevron's efforts to optimize its portfolio and focus on its core operations.

Chevron has recently initiated the auction process for two parcels of land, with details available on the EnergyNet online auction site.

- Parcel 1: Located in New Mexico, it encompasses 2,134 net acres.

- Parcel 2: Situated in both New Mexico and Texas, it covers an area of 29,901 acres.

The estimated combined value of these parcels is approximately $100 million, as per a source knowledgeable about the valuation of shale assets. Interested parties are required to submit their bids by July 27, according to the marketing brochures.

The larger parcel (Parcel 1) is anticipated to have a production output of around 770,000 barrels of oil and gas net. On the other hand, the smaller parcel (Parcel 2) is expected to yield approximately 1,818 barrels of oil and gas equivalent (boe) per day, according to the available documents.

Side deals

Chevron, the second-largest oil and gas producer in the United States, recently finalized a stock-and-debt deal worth $7.6 billion to acquire shale firm PDC Energy Inc. This acquisition comes after Chevron's notable purchase of Noble Energy in 2020, which significantly expanded the company's U.S. shale and international gas assets.

Chevron is currently engaged in discussions with Algeria, which possesses abundant shale gas reserves, regarding the acquisition of drilling rights. This potential agreement is anticipated to be concluded by the conclusion of this year. Recent reports have indicated that Chevron has initiated the procedure to divest its oil assets in the Democratic Republic of Congo. Industry experts estimate that these assets in Congo could yield up to $1.5 billion for the American oil giant.