Callon is set to purchase Percussion Petroleum's Delaware assets for $475 million while selling its Eagle Ford assets to Ridgemar for $655 million.

In a strategic step to optimize its operations, Callon Petroleum recently made headlines by sealing two deals on May 3, totaling a staggering $1.13 billion. The company is taking confident steps to bolster its presence in the Delaware Basin while bidding farewell to its stake in the Eagle Ford Shale.

Under the Permian Basin agreement, Callon is poised to acquire the coveted membership interests of Percussion Petroleum Operating II LLC. The transaction, carefully structured with a combination of cash and stock, has been appraised at an impressive value of around $475 million.

Closer Look at the Mergers and Acquisitions

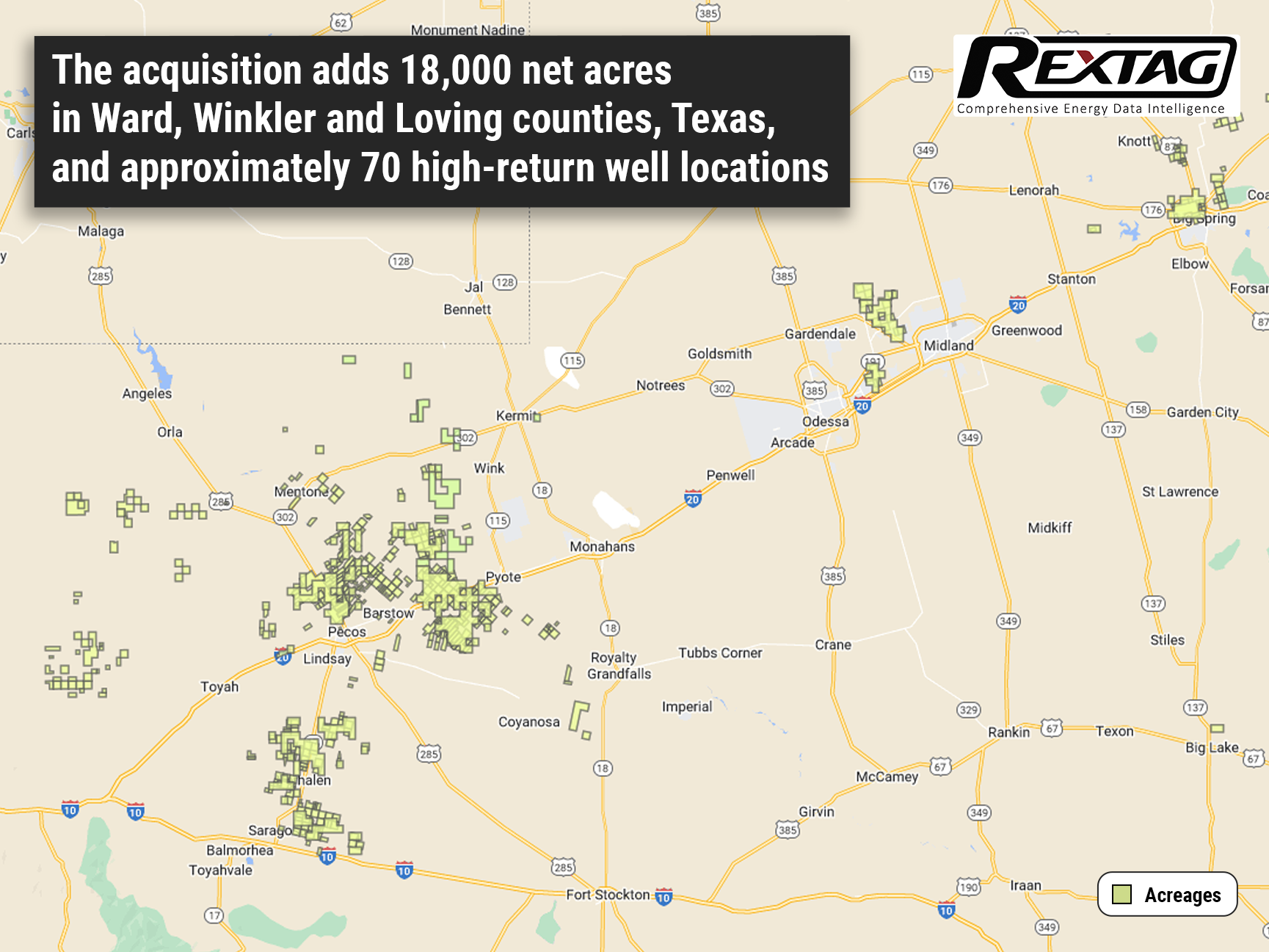

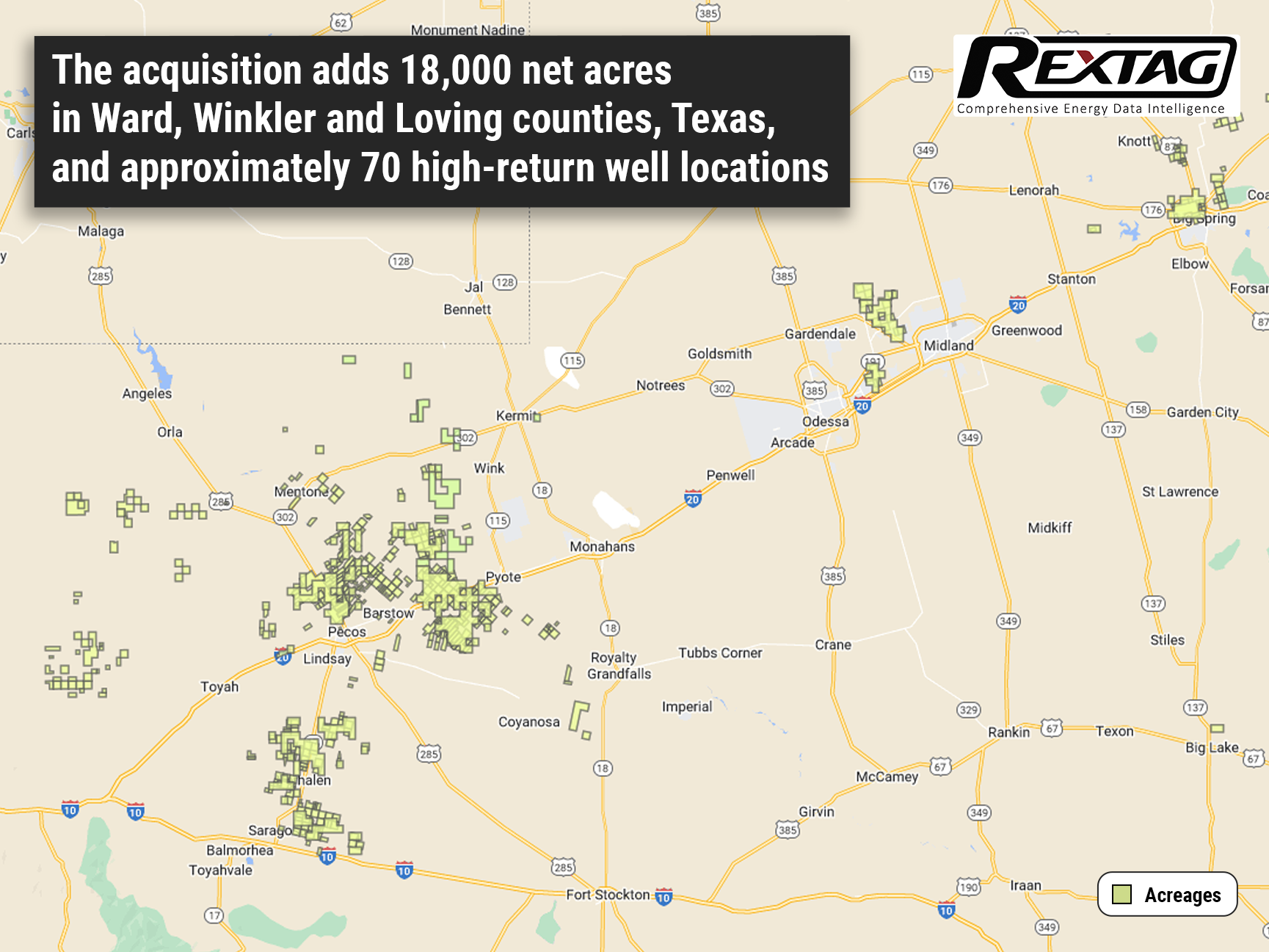

- Callon's strategic move to acquire Percussion Petroleum brings in approximately 18,000 net acres located in Ward, Winkler, and Loving counties, Texas.

- This addition includes a treasure trove of about 70 high-return well locations in the 3rd Bone Spring, Wolfcamp A, and Wolfcamp B formations.

- The average lateral lengths of these wells span an impressive 10,000 feet, showcasing their robust potential. The acquired acreage seamlessly aligns with Callon's existing core positions in the Delaware Basin, thereby leveraging the company's profound subsurface knowledge and operational expertise.

- Percussion's assets have exhibited impressive estimated production figures, with an average of approximately 14,100 barrels of oil equivalent per day (boe/d) in April 2023. Notably, around 70% of this production consists of oil, reflecting the attractive profitability of the assets.

- Eagle Ford Assets: Callon's Eagle Ford assets cover a substantial area, amounting to around 52,000 net acres. These assets have demonstrated their production capabilities, with estimated average production of approximately 16,300 boe/d as of April. Within this production, an impressive 71% comprises oil, indicating the asset's significant contribution to Callon's overall hydrocarbon portfolio.

Callon Petroleum Strategic Partnership with Ridgemar Energy in Eagle Ford

Callon has entered into a definitive agreement to acquire the membership interests of Percussion Petroleum Operating II LLC, further expanding its presence in the Delaware Basin.

The transaction with Percussion Petroleum involves approximately $475 million. In a separate deal, Callon has agreed to sell all its assets in the Eagle Ford to Ridgemar Energy Operating LLC. The transaction is valued at $655 million, with potential additional contingent payments of up to $45 million based on WTI prices.

Ridgemar Energy Operating LLC, supported by Carnelian Energy Capital Management LP, will acquire 100% ownership of Callon's wholly owned subsidiary, Callon (Eagle Ford) LLC.

The completion of both transactions is subject to customary terms and conditions, with an expected simultaneous closing in July 2023. The effective date for both deals is set at January 1, 2023.

Callon Petroleum, led by President and CEO Joe Gatto, is poised to unlock substantial value from Percussion's assets while strategically aligning its operations. Gatto expressed excitement about the synergies between Percussion's assets and Callon's core Delaware position, foreseeing significant opportunities for growth.

In a recent press release, Gatto emphasized the transformative impact of these combined transactions on Callon's overall business landscape. He highlighted how these strategic moves will bolster the company's capital structure, enhance margins, and extend its already impressive inventory in the Permian Basin, known for its exceptional quality.