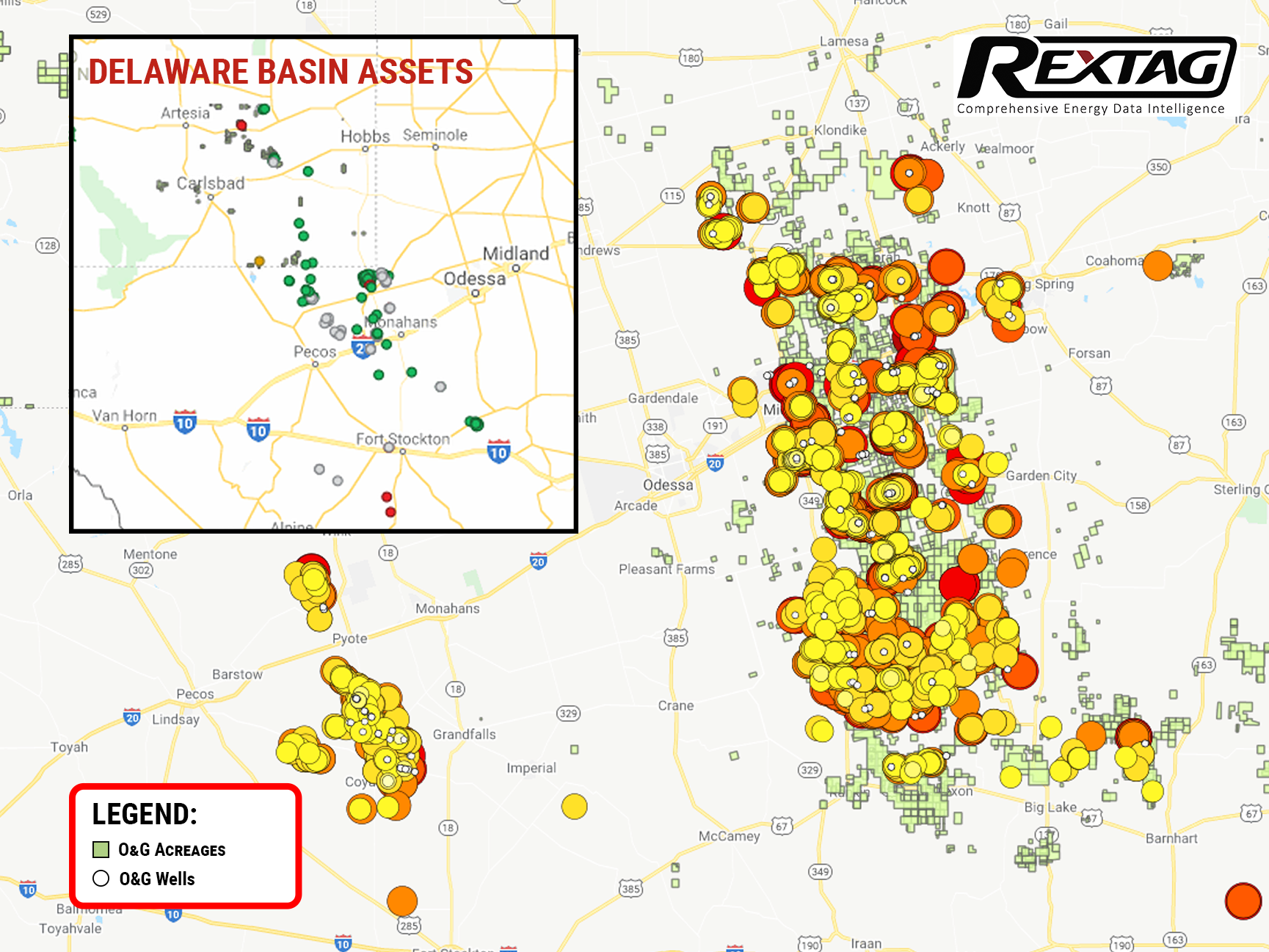

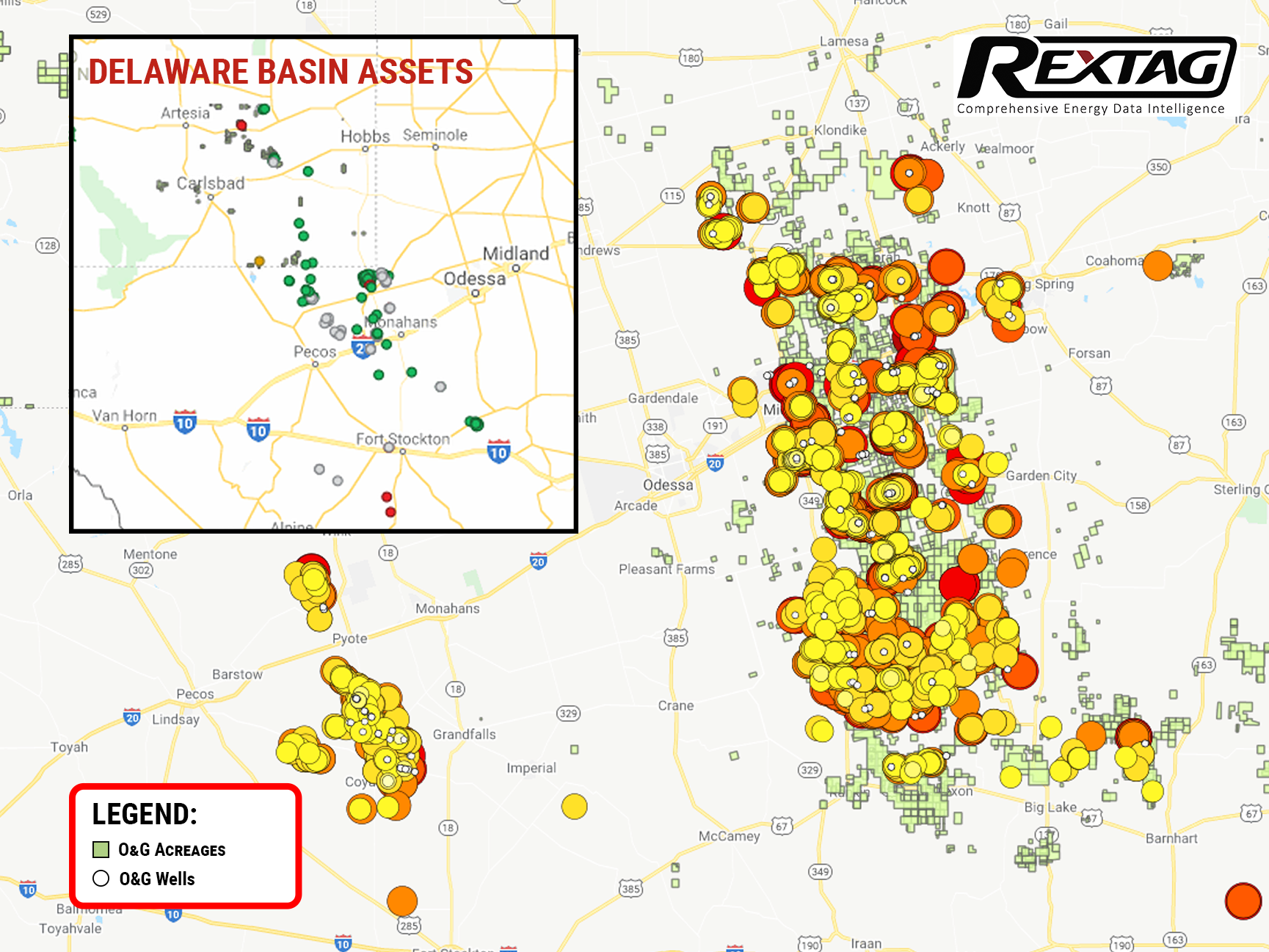

Pioneer Natural Resources Co PXD.N, one of the nation's largest oil companies by output, has put up for sale its onshore assets in the Delaware basin of Texas intending to raise over $2 billion.

This move comes to light following crude oil prices rebound after last year's pandemic-induced crash. Gas and oil are hiking to new heights as the demand for exports is rising. The price of West Texas Intermediate Crude is now at about $70 per barrel. As a result of the recovery, producers are finally able to shed some underperforming properties, igniting a shale consolidation wave.

In the event of a successful sale, Pioneer would be left concentrating on the Midland Permian, its traditional base of operation.

Through divestment, Pioneer likely wants to streamline its upstream portfolio. Since at present, investors are pressing more and more upstream companies for a higher shareholder value, not production, so they are forced to focus on finding profitable resources instead.

The need for Pioneer to restructure its business and reduce debt is understandable, giving a big splurge earlier this year when it completed two acquisitions valued at over $1 billion each. The oilfield services business was already sold by Pioneer for an undisclosed sum in March to kickstart the process. As speculated, the company has agreed to sell approximately 20,000 net acres in western Glasscock County, Texas, to Laredo Petroleum for as much as $230 million under its assets sale plan.

Pioneer paid $6.2 billion for Midland-basin rival DoublePoint Energy after closing the Parsley deal in January. As a result of the deals, companies' total debt amounted to no less than $6.9 billion at the end of June, spiking more than 100% up from $3.1 billion six months prior.

With this convenient acquisition, the company now owns 97,000 acres in the Permian Basin, making it one of the biggest producers there. Through the transaction, the acquirer now controls approximately 1 million acres of basin land.

Apart from offsetting its debt, Pioneer also recently pushed forward with the notion of paying a variable quarterly dividend starting in September instead of the first quarter of 2022 as was planned earlier. Not surprising, considering boosted buybacks and dividends are part of the wider effort of shale companies to improve investor confidence following years of sub-par returns compared to other industries.

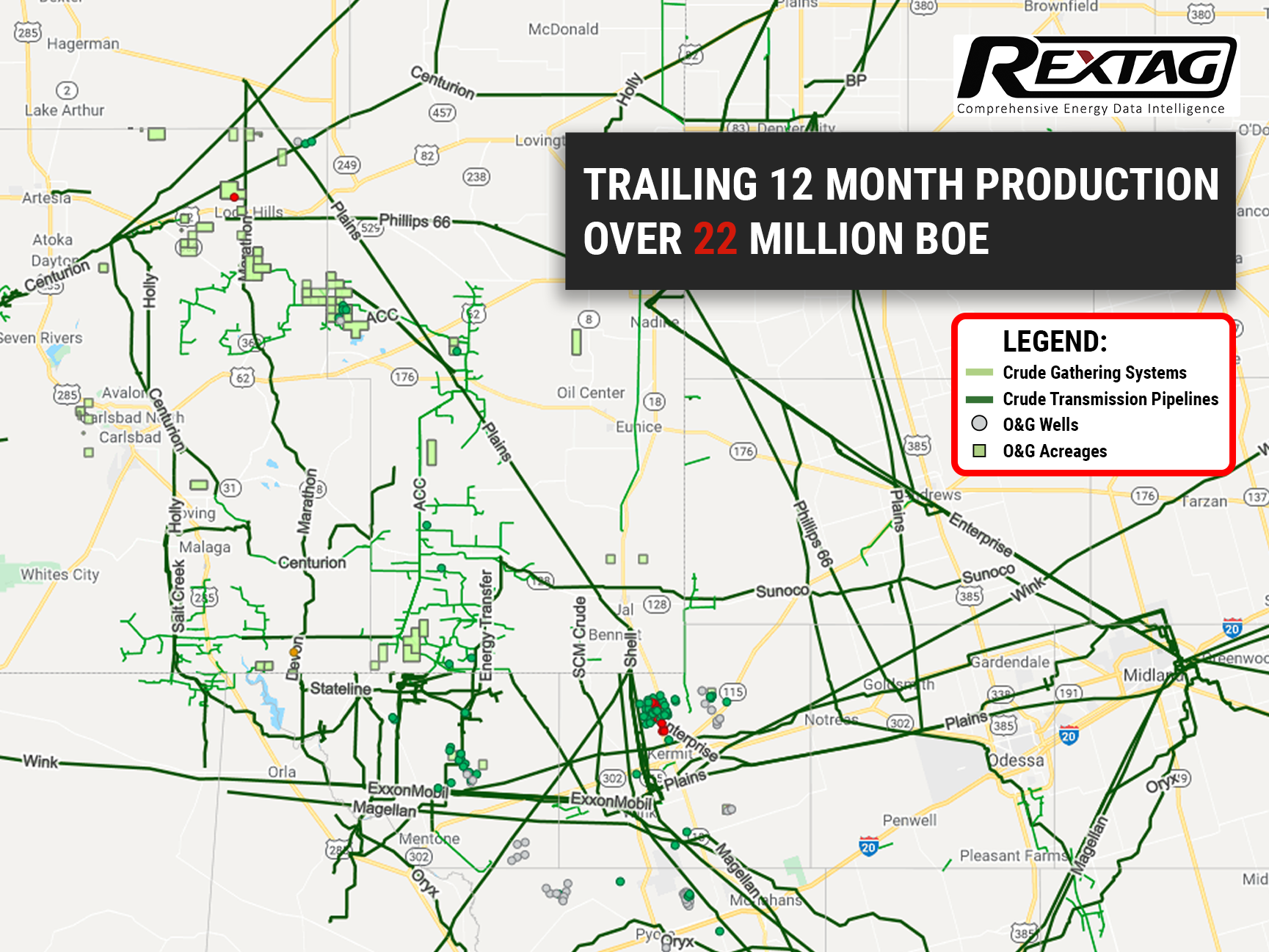

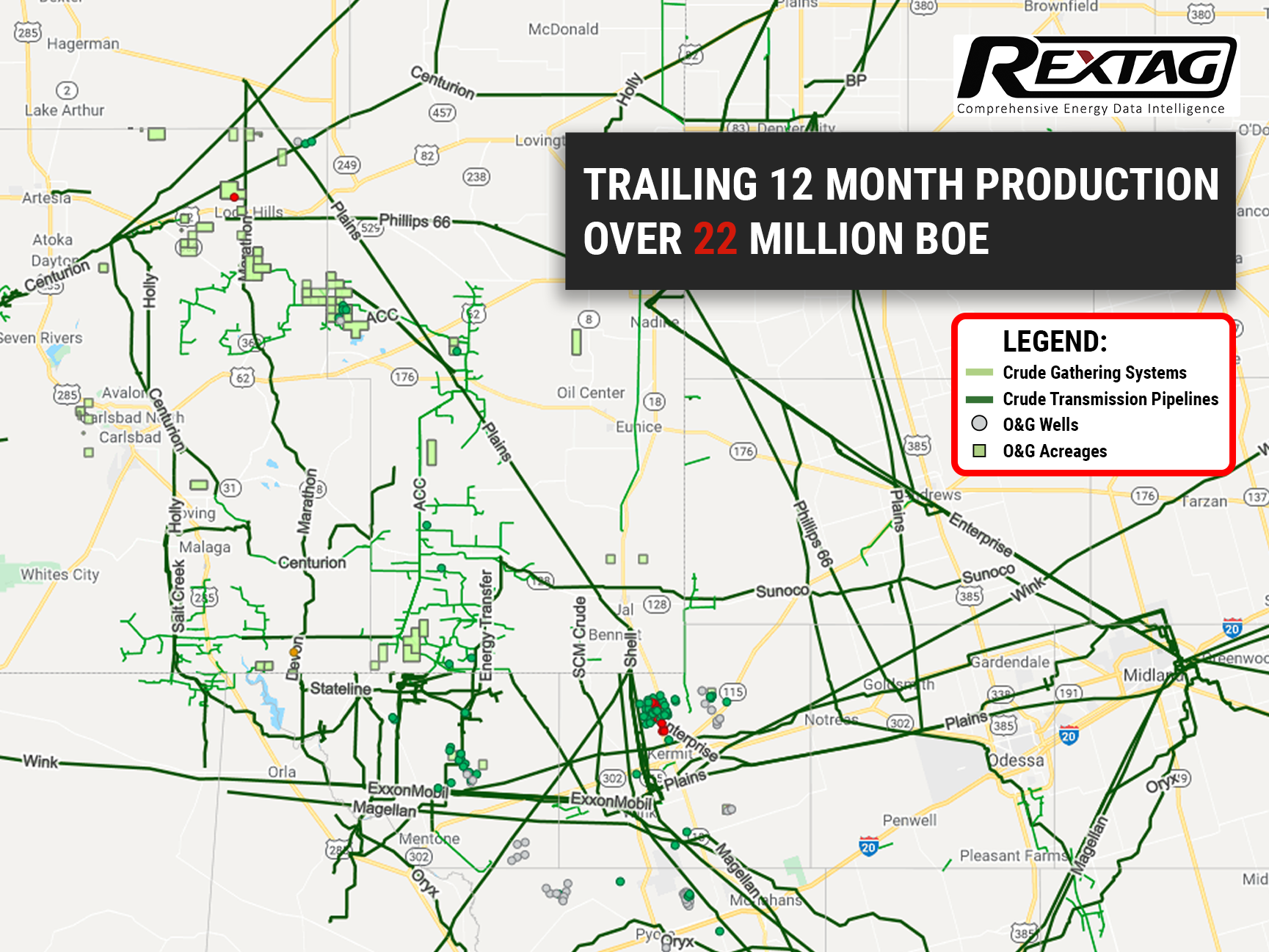

Therefore a detailed analysis of such intel becomes a useful necessity for any financial endeavor. The map-based asset intelligence provided by Rextag, as shown, allows business development teams to rapidly and accurately analyze and grab all and any opportunities such as Pioneer's proposed sale from a holistic standpoint, including midstream.