OXY has been the leader in Permian Basin production for the past five years. Currently, the Houston-based oil and gas company is deepening its presence in the basin with a $12 billion acquisition of CrownRock, adding over 94,000 acres in the Midland Basin and increasing its oil output by about 170,000 barrels per day.

Occidental announced an increase in its proved reserves to 4.0 billion barrels of oil equivalent by the end of December 2023, up from 3.8 billion the previous year. Activities in the Permian largely fueled this rise. Occidental added approximately 303 million barrels through infill development projects as well as new discoveries and the further development of existing fields brought in another 153 million barrels.

Side Facts About OXY Outside Permian

OXY aims to increase its total production to between 1.22 and 1.28 MMboe/d in 2024. This target represents a 2.2% increase from the average production in 2023.

In the last quarter of 2023, Occidental's total production was 1.23 MMboe/d, including 285,000 boe/d from the Rockies.

Occidental holds approximately 800,000 net acres in the D-J Basin, spanning across Colorado, where recent stringent regulatory measures have been introduced for drilling wells. Also, the company has significant interests further north, with over 300,000 net acres in the Powder River Basin, primarily located in Converse and Campbell counties, Wyoming.

Now OXY is looking into selling Western Midstream Partners. OXY focuses on natural gas pipelines in the U.S., its worth is around $20 billion.

But who else has competed with Oxy in recent years? Here's a look at the companies that have emerged as production leaders in 2022.

Turn Back to 2022

The year 2022 brought new opportunities to the U.S. economy in various domains that had not been fully developed. Oil and natural gas production facilitated economic growth, especially in the Permian Basin.

Compared with other U.S. basins, the Permian Basin derived benefits from lower operational costs, better access to oilfield services, and its proximity to U.S. Gulf Coast refineries and export facilities. The core areas of the Permian Basin, including its Delaware and Midland sub-basins, consisted of multiple stacked shale formations.

According to the U.S. Energy Information Administration (EIA), oil output in the Permian in Texas and New Mexico, the largest U.S. shale oil basin, was predicted to grow by almost 50,000 barrels per day (bpd) to a record 5.453 million bpd in November 2022.

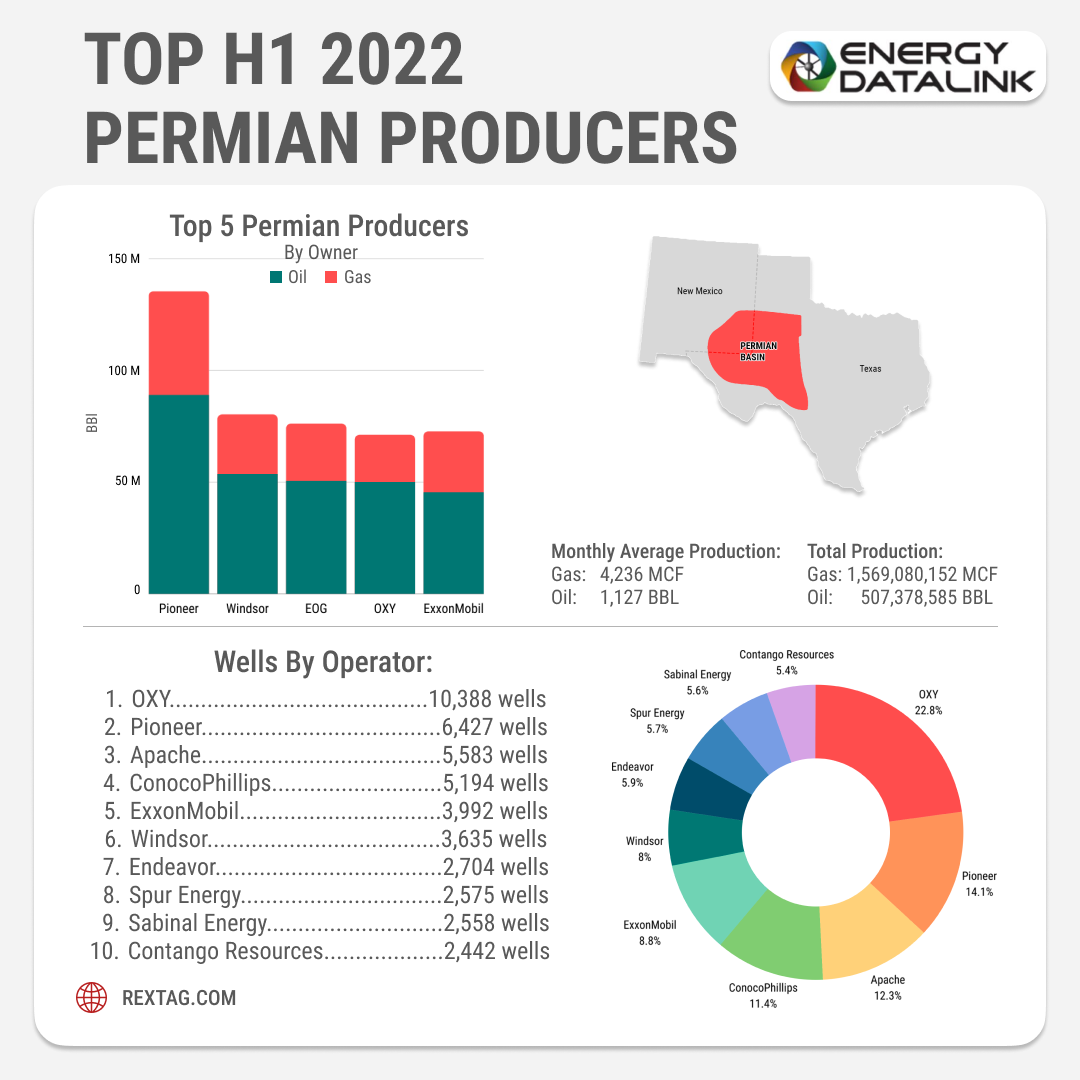

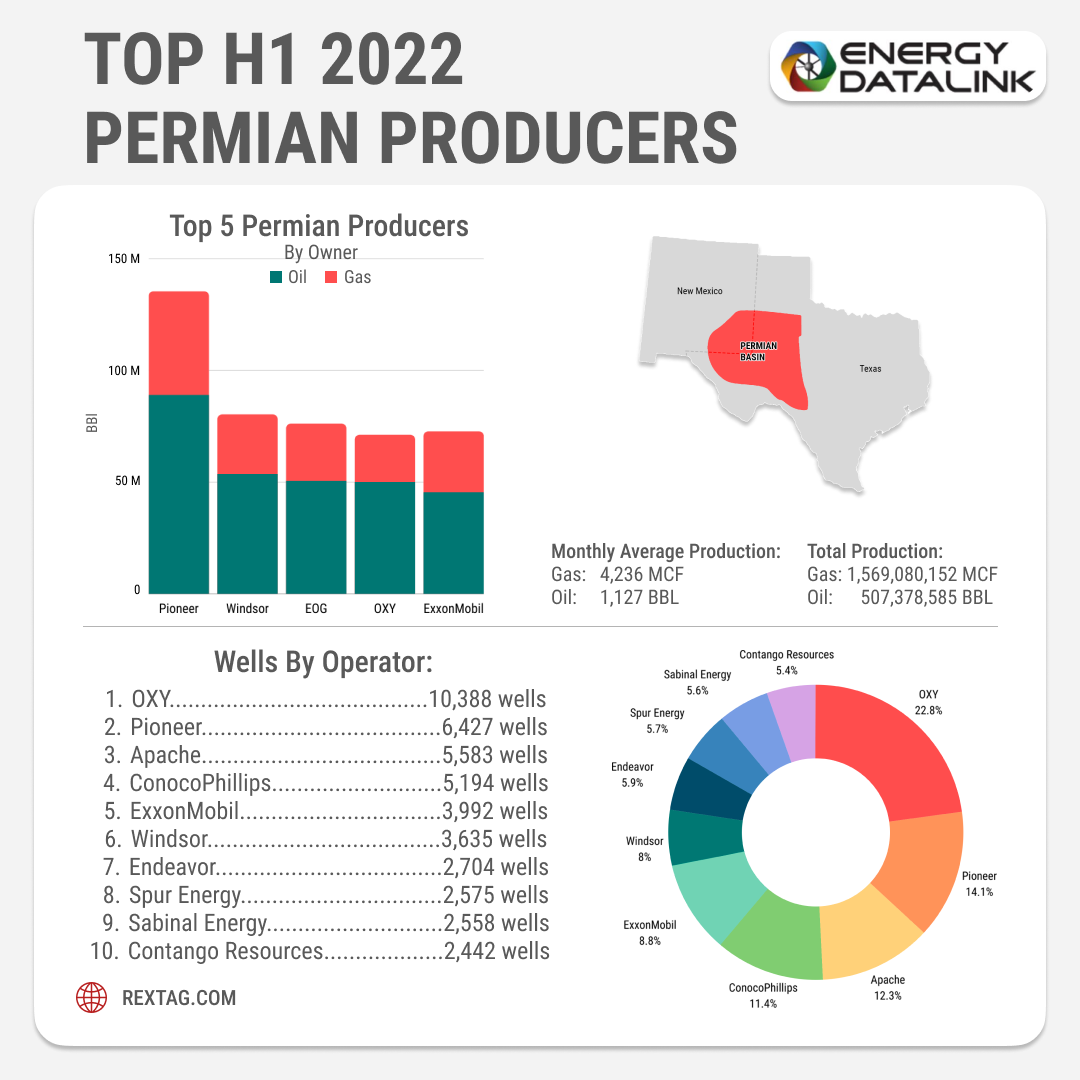

In 2022, the total production was 1.6 billion MCF for gas and 507 million BBL for oil. The monthly average production in the Permian Basin was 4,236 MCF for gas and 1,127 BBL for oil.

The list of the top 5 Permian producers included Pioneer, Windsor, EDG, OXY, and ExxonMobil.

Rextag`s info showing Top H1 2022 Permian Producers

At that time, OXY had the most significant number of wells (10,388) that were delivering steady production to domestic and foreign customers. Other top producers operated roughly twice as few wells (4,000-6,000).

In 2023, strong production growth from the Permian basin was anticipated, generating a first-half 2022 average crude oil production of 5.02 million b/d, a growth of 13.6% year-over-year. Constant supply chain bottlenecks, shortages of qualified personnel, and a fluctuating drilled-but-uncompleted (DUC) well inventory could have dampened overall expectations, but the play focused on many US shale operators.

TOP 2023 Permian Producers Update

In 2023, the Permian Basin made up 46% of the U.S.'s oil supply. Other tight oil areas contributed an additional 22%. The remaining 32% came from traditional and offshore oil sources, which haven't grown in the last 15 years.

In November 2023, the Permian Basin hit a new high in natural gas production, with an average flow of 6.3 billion cubic feet per day. (https://www.hartenergy.com/exclusives/east-daley-permian-basin-gas-flows-hit-record-november-207484)

According to Wood Mackenzie, investments in the Permian Basin reached over $100 billion in 2023 (previous high of $65 billion in 2019).

|

Rank

|

Operator

|

Average Q2 2023 Gross Operated Production (BOE/D)

|

|

1

|

PIONEER NATURAL RESOURCES

|

816,725.07

|

|

2

|

EOG RESOURCES

|

656,222.61

|

|

3

|

CONOCOPHILLIPS

|

606,318.73

|

|

4

|

OCCIDENTAL PETROLEUM

|

586,244.26

|

|

5

|

EXXON

|

583,679.87

|

|

6

|

DIAMONDBACK ENERGY

|

496,397.16

|

|

7

|

DEVON ENERGY

|

472,515.53

|

|

8

|

CHEVRON

|

388,028.49

|

|

9

|

MEWBOURNE OIL CO

|

363,613.05

|

|

10

|

ENDEAVOR ENERGY

|

319,008.02

|

Top 10 Permian Basin Operators for Q2 2023

The merger between Exxon Mobil and Pioneer Natural Resources, valued at $60 billion and announced in October. Post-merger, Exxon Mobil's production in the Permian is expected to increase to around 1.3 million barrels of oil equivalent per day, positioning it as the top producer in the region.

Exxon Mobil has set a goal to expand its Permian production to 2 million barrels of oil equivalent per day by 2027, up from an initial target of 1 million.

In 2023, Civitas Resources made a step into the Permian Basin, investing nearly $7 billion. They entered by buying two companies, Tap Rock Resources and Hibernia Energy III, which are active in the Permian's Midland and Delaware areas.

Civitas didn't stop there; they also bought Vencer Energy, a company in the Midland Basin, for $2.1 billion in October. This company was supported by Vitol.

In another big deal in 2023, Permian Resources spent $4.5 billion to buy Earthstone Energy. This added valuable locations and increased their production in the Midland Basin.

Ovintiv also made a major purchase in the recent year, spending $4.275 billion on three companies in the Midland Basin, all backed by EnCap Investments.

Endeavor Energy Partners, another key player, is doing well in the Midland Basin's central area. According to a Fitch Ratings report from November, they're producing 331,000 barrels of oil equivalent per day, which is a 25% increase from 2022.