ONEOK Inc. and Magellan Midstream Partners LP have announced a merger agreement that will result in the formation of a formidable midstream company headquartered in Tulsa, Oklahoma. The deal will bring together their respective assets and expertise, resulting in a powerful entity boasting an extensive network of approximately 25,000 miles of pipelines primarily focused on transporting liquids.

Truist Securities analysts noted that this deal is one of the largest U.S. midstream transactions in recent years. Pierce H. Norton II, President and CEO of ONEOK stated that the combined entity will be a diversified North American midstream infrastructure company with a focus on fee-based earnings, a strong balance sheet, and the ability to deliver essential energy products and services to customers while generating solid returns for investors.

ONEOK Inc. and Magellan Midstream Partners LP are joining forces to create a major midstream entity valued at $60 billion. ONEOK will acquire all of Magellan Midstream's outstanding units in a cash-and-stock transaction worth $18.8 billion, including assumed debt. This agreement will provide ONEOK with predominantly fee-based refined products and crude oil transportation business, serving as a valuable addition to its existing NGL infrastructure system.

According to an investor presentation, current ONEOK shareholders are projected to hold approximately 77% of the company after the merger, while current Magellan unitholders will own the remaining 23%. In order to facilitate the cash aspect of the transaction, ONEOK has secured $5.25 billion in committed bridge financing. The company will assume around $5 billion of existing net debt in order to acquire Magellan. The merger will involve Magellan being integrated into a wholly-owned subsidiary of ONEOK, and the closing of the deal is anticipated to occur in the third quarter.

Expanding operations

The headquarters of the merged company will remain in Tulsa, Oklahoma, where both ONEOK and Magellan are currently based. ONEOK intends to nominate one of its two directors to serve on the board of Magellan's general partner.

ONEOK foresees that the merger will position the company to capitalize on export opportunities. The transaction has the potential to generate annual synergies exceeding $400 million within the next two to four years. Truist analysts suggest that the combined company's complementary assets could lead to operational synergies of at least $200 million once integration is complete.

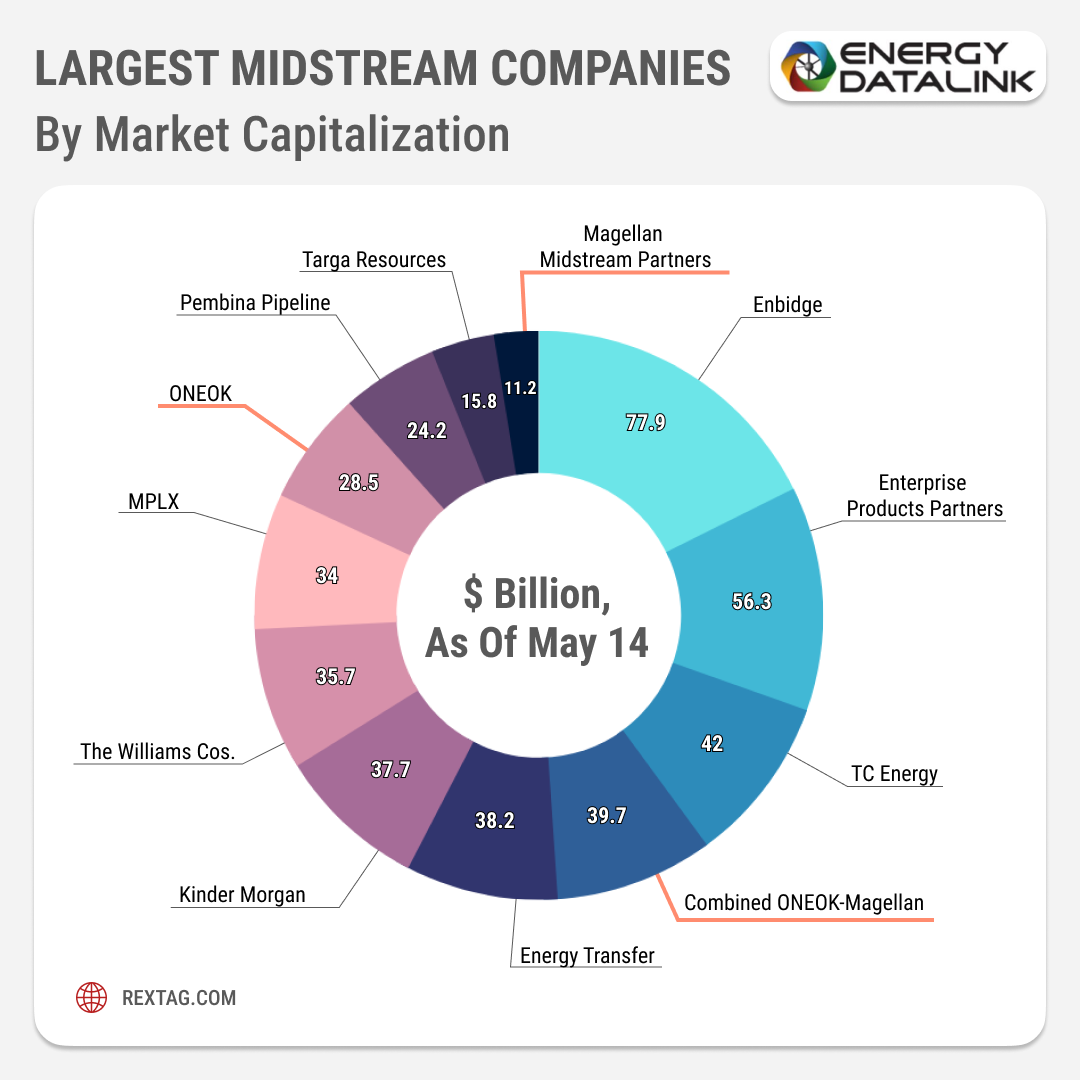

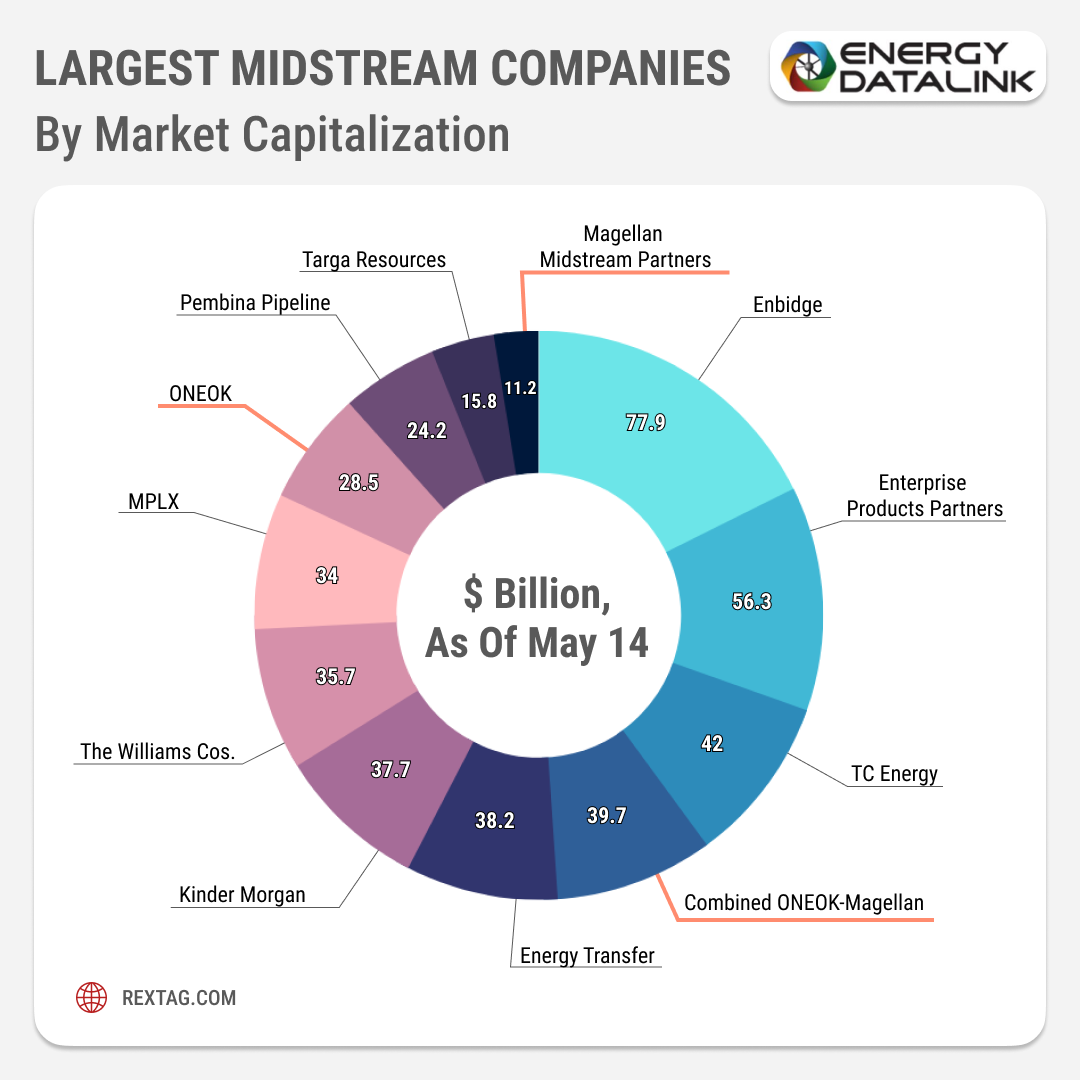

- The merger will establish a dominant player in the midstream sector, with a combined market capitalization of approximately $40 billion. This valuation surpasses all other public companies in the industry, except for Enbridge, Enterprise Products Partners, and TC Energy.

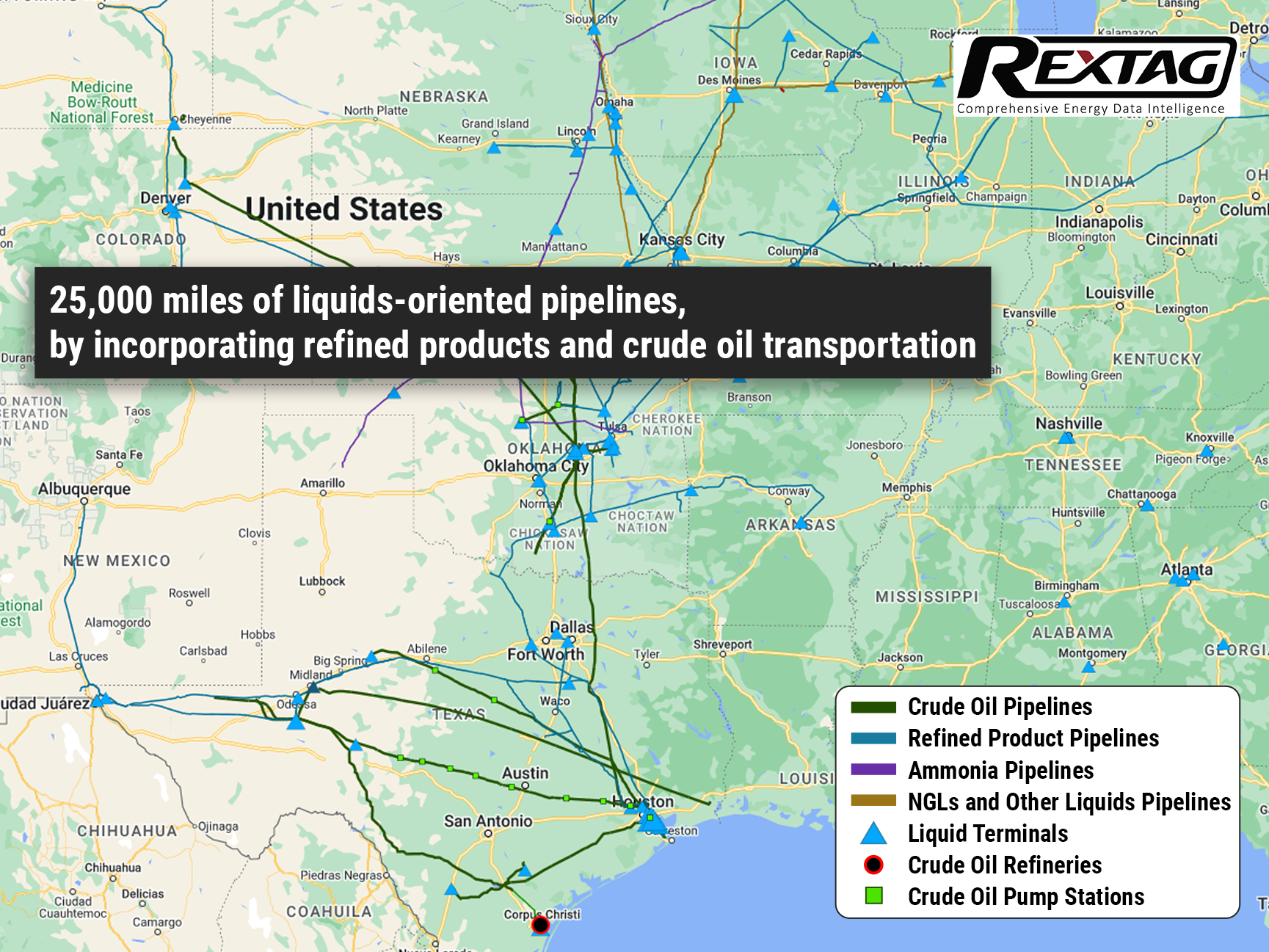

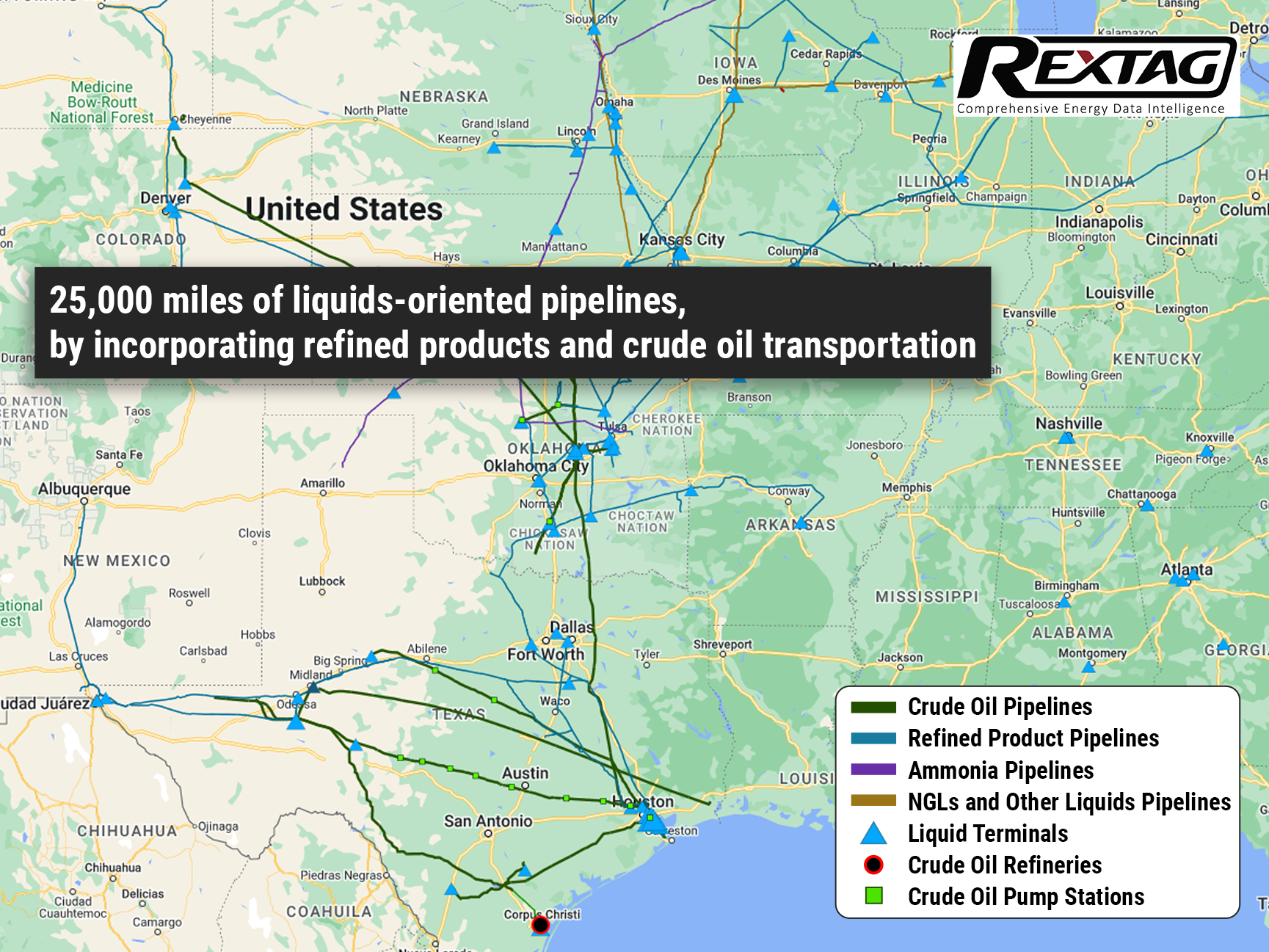

- The newly formed entity will possess over 25,000 miles of pipelines dedicated to transporting liquids, along with significant assets in the Gulf Coast and Midcontinent regions.

- ONEOK anticipates that the agreement will have a positive impact on earnings per share (EPS) starting in 2024, with an expected annual EPS accretion ranging from 3% to 7% between 2025 and 2027.

- The company foresees annual synergies resulting in savings of at least $200 million.

Once the deal is finalized, ONEOK's CEO, Norton, will continue leading the combined company, maintaining his position.

Merger will give the combined company strong assets across key basins

Truist analysts are highly optimistic about the deal, considering its attractive valuation compared to recent transactions and the potential for earnings growth from the assets, all while maintaining a solid financial position.

Truist analysts Neal Dingmann and Bertrand Donnes wrote in a May 14 note:

- “We expect the pro-forma company to be able to de-lever toward its 3.5x [leverage] target in relatively short order though the time to reach the debt goal could be extended in order to prioritize capital allocation toward growth projects, particularly the likely debottlenecking capacity hiccups in the Permian region”.

- “While OKE buying MMP is one of the first large midstream transactions we have seen in several quarters, we note that Plains All American Pipeline … has similar assets to OKE and trades at an attractive multiple potentially setting the company up as next to be bought“.

The analysts highlighted the positive aspects of the merger, stating that the combined company will have strong assets in important regions, giving ONEOK a favorable position. They also noted that ONEOK's strong balance sheet, resulting from previous efforts to reduce debt, will provide stability. The addition of Magellan's expertise in crude oil and refined products will complement ONEOK's existing operations, which focus on gas pipelines, NGLs, and natural gas G&P. This expansion will broaden the company's capabilities and reach.