As the leaves fall and we settle into Halloween’s cozy, pumpkin-spiced vibes, it’s not just the ghostly shadows creeping through the energy sector; major oil companies have reported mixed Q3 earnings, facing various challenges and surprises. While some players faced profit slumps reminiscent of a seasonal scare, others found treats hidden among their strategies and diversified portfolios. Here’s a look at how ExxonMobil, BP, CNOOC, Phillips 66, TotalEnergies, ConocoPhillips, and Shell fared in the last quarter.

Grab your pumpkin latte and settle in for a spooky yet festive wrap-up of the energy sector! ????

ExxonMobil: A Frightening Drop in Profit

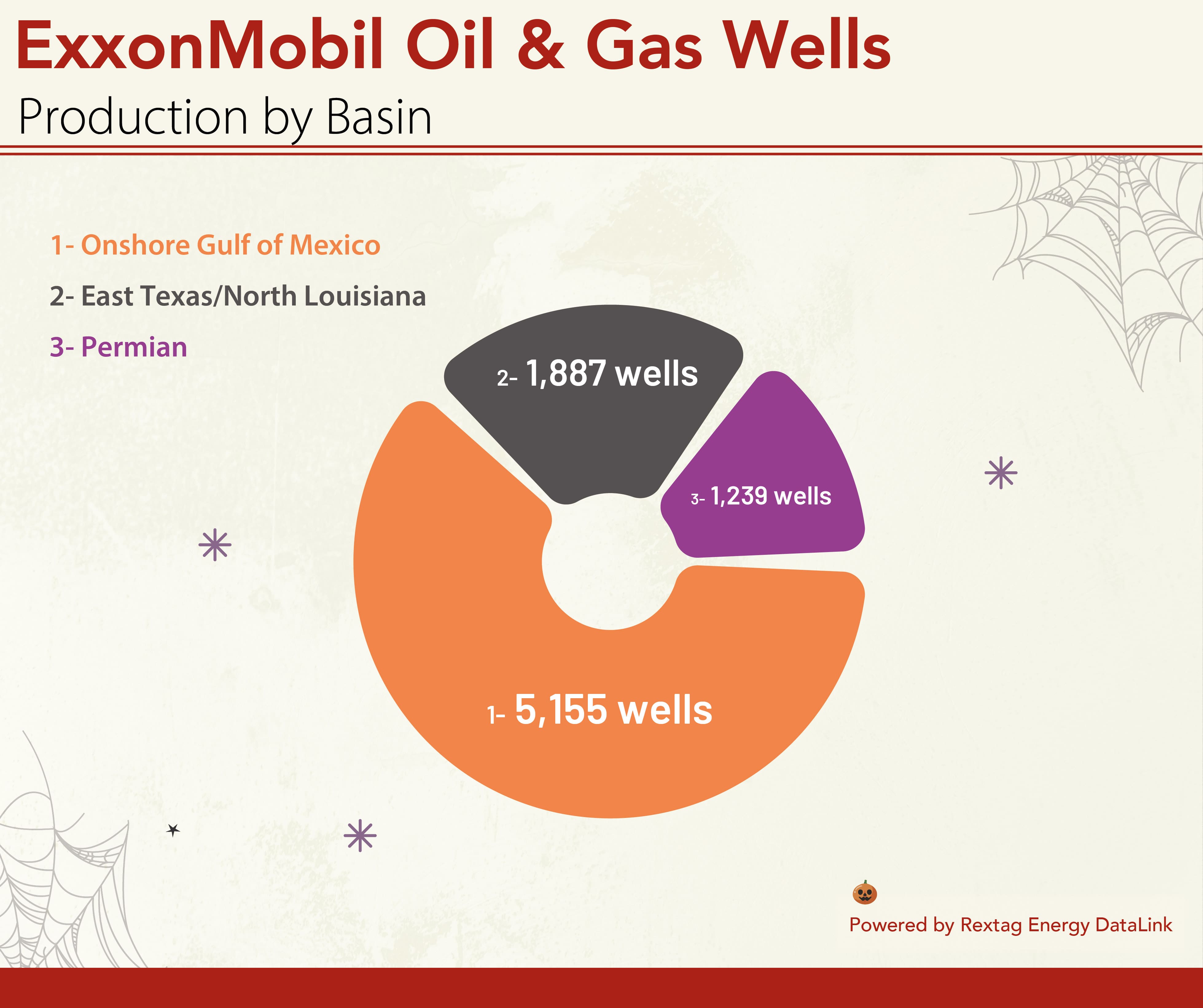

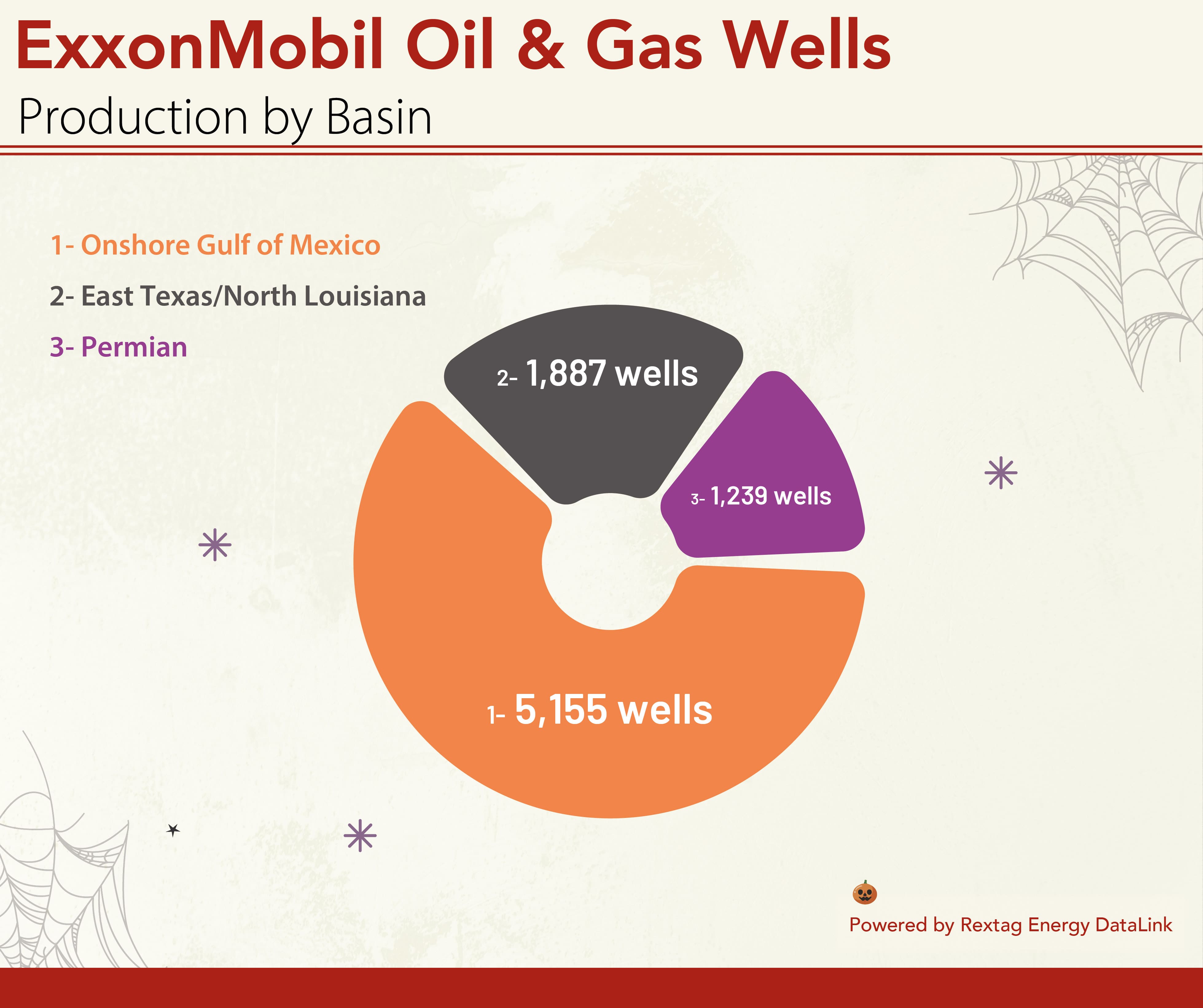

ExxonMobil saw a chilling 53% drop in Q3 profits, falling to $9.07 billion from a record high last year when crude prices soared. Earnings per share plummeted to $2.25, and the decline was largely due to a 14% dip in crude realisations and a spine-tingling 60% decrease in natural gas realisations. Despite this trick rather than treat, ExxonMobil boosted production by 80,000 oil-equivalent barrels daily, driven by growth in the Permian Basin and Guyana.

Darren Woods, ExxonMobil’s CEO, remains undeterred, emphasizing a commitment to steady returns while reducing emissions. With a boosted fourth-quarter dividend and recent acquisitions, Exxon seems determined to keep the lights on, even if the energy market feels more haunted than helpful.

BP: Bewitched by Soft Margins and Weaker Trading

BP also had its share of frights, reporting a 30% profit drop to $2.3 billion, its lowest in nearly four years. The company faced soft refining margins and weaker oil trading results, even as production rose by 3% year-over-year. BP’s acquisition of a full stake in its solar venture, Lightsource BP, pushed its net debt up, adding another ominous factor to the quarter’s performance.

Despite the challenges, BP held steady on its 8-cent-per-share dividend and its $1.75 billion share buyback. Analysts noted that BP may revise its guidance in February, suggesting 2025 might bring changes to its payout ratio. But for now, BP’s resolve to weather market turmoil seems to keep the chills at bay.

CNOOC: Treats Amid the Tricks with Higher Output

Unlike its Western counterparts, China’s CNOOC brought home a Halloween treat with a 9% increase in Q3 net income, thanks to a robust 7% boost in oil and gas production. Despite a dip in realized oil prices and a 13.5% decline in revenue, CNOOC’s strong output, especially from offshore China and the Payara project in Guyana, helped keep profits on a high note.

With plans to reach a record-breaking production target this year, CNOOC is showing resilience in a market haunted by declining prices. Their positive results serve as a reminder that even in tricky times, treats are possible with the right focus on output and expansion.

Phillips 66: Chemical and Midstream Magic

Phillips 66 surprised investors with a Q3 profit beat, driven by strength in its chemicals and midstream segments. Adjusted profits rose by 15.6%, thanks to increased natural gas liquid volumes flowing through its extensive pipeline network. Despite low refining margins—trickier than an elaborate Halloween maze—Phillips 66 managed to deliver a solid performance.

The company’s share price took a slight dip, but the strength in its chemical sector and cost-cutting measures kept the spooky shadows at bay, helping Phillips 66 maintain a steady course through the quarter.

TotalEnergies: Spooked by Lower Margins

TotalEnergies had a ghostly drop in Q3 income, hitting a three-year low of $4.1 billion as refining margins and output outages cast a shadow over its results. With earnings down 37% year-on-year, TotalEnergies faced the reality of global refining struggles and weaker economic conditions.

Despite the challenges, the company maintained its $2 billion share buyback program and confirmed a third interim dividend. Analysts recognized the challenges but noted that TotalEnergies’ disciplined approach to capital expenditures would help maintain stability for the future. Even with a few spooky surprises this quarter, TotalEnergies is bracing for a comeback.

ConocoPhillips: A Sweet Profit Beat and Buyback Surge

Amid the Halloween chills, ConocoPhillips emerged with a treat, surpassing Q3 profit estimates thanks to higher production and a $20 billion boost in share buyback authorization. Production climbed 6%, and the company is optimistic about its upcoming $22.5 billion Marathon Oil acquisition, expected to yield substantial synergies.

While oil prices were slightly lower, ConocoPhillips is betting on continued demand and anticipates steady returns for its shareholders. With its focus on efficiency and expansion, ConocoPhillips has shown that there’s always room for a little seasonal treat amid the spooky market volatility.

Shell: A Gas-Powered Halloween Surprise

Lastly, Shell wrapped up the season with a treat, as its gas trading division helped the company beat Q3 earnings expectations. Adjusted earnings reached $6.03 billion, driven by strong gas volumes and improved upstream operations. Even as refining margins weakened, Shell’s resilience—bolstered by efficient operations and strategic investments in LNG—helped shield it from the Halloween chills.

Shell declared a quarterly dividend and upheld its share buyback plan, showing confidence in its balanced approach to energy investments. With CEO Wael Sawan’s focus on disciplined spending and sustainable returns, Shell has built a buffer against market volatility and is well-positioned to handle future frights.

Tricks, Treats, and Haunted Markets

As Halloween comes to a close, it’s clear that the energy sector is navigating a mixed bag of tricks and treats. From ExxonMobil’s and BP’s haunted profit drops to the surprises of CNOOC, ConocoPhillips, and Shell, each company has found a unique path through the foggy landscape of Q3. This season of chilling declines and cozy profit beats reminds us that resilience, strategy, and a dash of seasonal spirit are just as essential in business as in celebrating Halloween.

So as you enjoy your Halloween night, remember these energy giants—facing both tricks and treats—who continue to fuel the world, even when the market gets a little spooky. Happy Halloween, and may your treats be sweet and your tricks be few! ????