Oil productivity in the Permian Basin in Texas and New Mexico is supposed to go up 88,000 bbl/d to a record 5.219 million bbl/d in June, as the U.S. Energy Information Administration (#EIA) announced in its report on May 16.

The EIA forecasts that total output in the main U.S. shale oil basins will increase 142,000 bbl/d to 8.761 million bbl/d in June, the most since March 2020.

As for the Bakken in North Dakota and Montana, the oil productivity will rise 17,000 bbl/d to 1.189 million bbl/d in June, the most since December 2020.

Meanwhile, in the Eagle Ford in South Texas, the output will increase 27,000 bbl/d to 1.176 million bbl/d in June, its highest since April 2020.

Also, total natural gas output in the big shale basins will substantially rise 0.8 Bcf/d to a record 91.8 Bcf/d in June, the EIA predicts.

In the largest shale gas basin, the productivity in Appalachia in Pennsylvania, Ohio and West Virginia will grow up to 35.7 Bcf/d in June, its highest since beating a record 36 Bcf/d in December 2021.

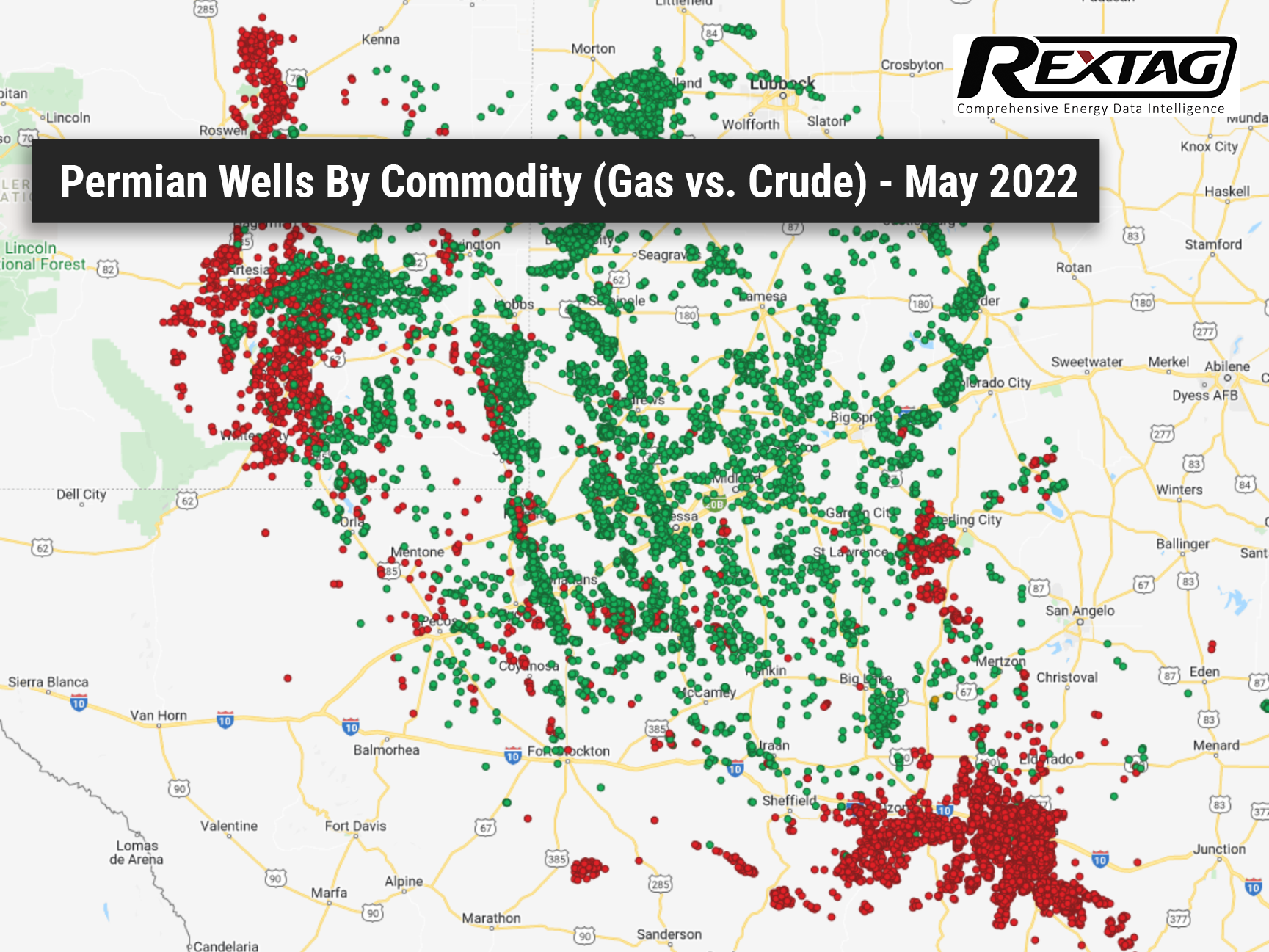

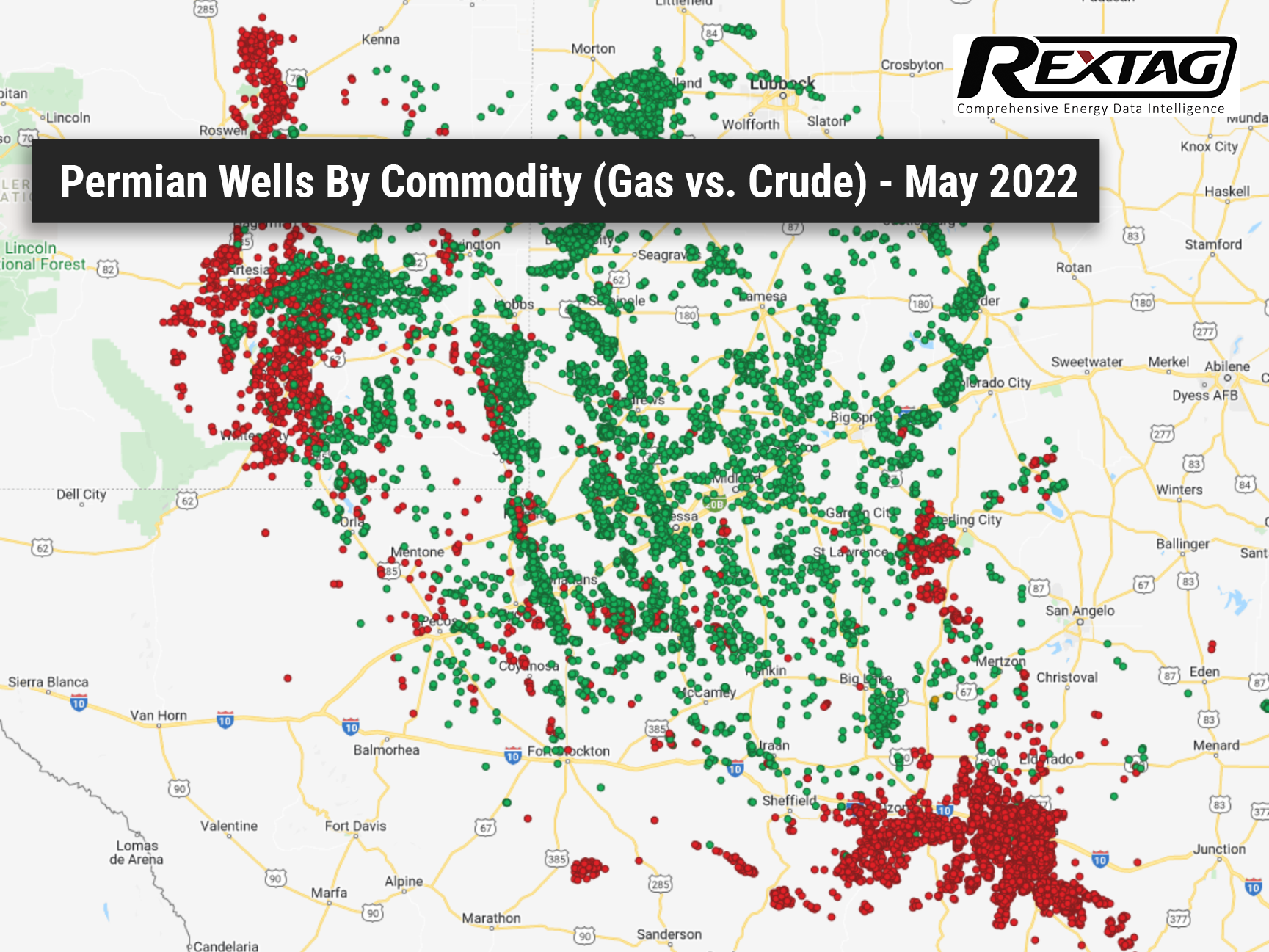

Gas output in the Permian Basin and the Haynesville in Texas, Louisiana and Arkansas will rise to record highs of 20 Bcf/d and 15.1 Bcf/d in June, respectively.

Speaking of the Permian future output, putting hands on upcoming changes in production has recently been made easier with the new Rextag's service - Pad Activity Monitor. Thanks to satellite imagery and artificial intelligence, customers are able to monitor the oil and gas wells and are provided with near real-time activity reports related to drilling operations.

This service helps to get the whole information about potential increases or decreases in oil and gas production ahead of others. Moreover, customers have the opportunity to see how potential volumes could impact storage and transportation across the Permian Basin.

However, it is noticed that productivity in the largest oil and gas basins has decreased every month since setting records of new oil well production per rig of 1,544 bbl/d in December 2020 in the Permian Basin, and new gas well production per rig of 33.3 MMcf/d in March 2021 in Appalachia.

In June, EIA predicts new oil well production per rig will drop to 1,129 bbl/d in the Permian Basin, the lowest since August 2020, and new gas well production per rig will drop to 28.5 MMcf/d in Appalachia, the lowest since September 2020.

EIA declared producers drilled 874 wells and completed 944, both the most since March 2020, in the most significant shale basins in April.

That left total DUCs down 70 to 4,223, the lowest since at least December 2013, as claimed by EIA data going back that far. The number of DUCs available has dropped for 22 months in a row.