Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

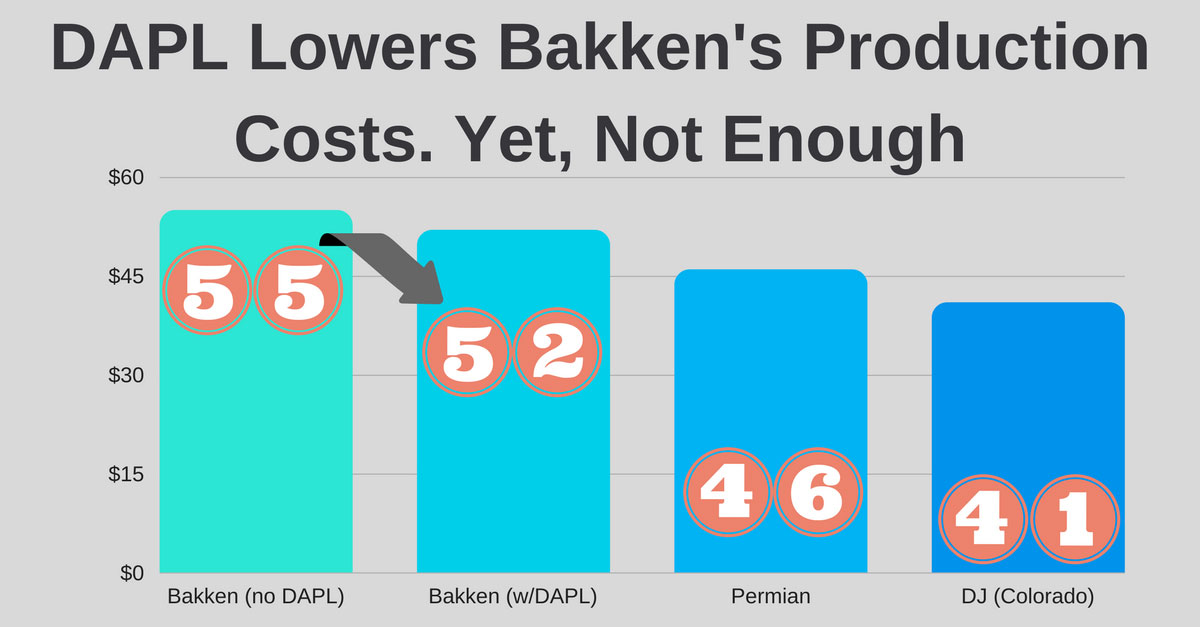

Bakken After DAPL Is in Operation: Still Hard to Compete

10/27/2017

North Dakota’s Bakken shale play will remain at certian disadvantage against Texas and Oklahoma even after the DAPL pipeline is in full service.

The break-even cost drilling cost for the basin is estimated to drop to $52 a barrel from $55 due to shift away from rail transportation to the DAPL. However, that compares with about $46 on average in Texas’s Permian play and $41 in Colorado’s DJ basin.

The 1,172-mile (1,886-kilometer) pipeline is designed to ship as much as 570,000 barrels of crude.

Bakken was named for Henry Bakken, a North Dakota farmer whose land hosted the first well in the region in the early 1950s,

It is expected to produce an average of 1.1 million barrels a day of oil this year and next, a figure lower than the 1.2 million barrels produced in 2015, according to the Energy Information Administration.

At the same time, Permian production is expected to reach 2.9 million barrels a day by the end of next year, the EIA said in July.

Bakken activities are easy to trace and examine with a complete and up-to date oil and gas information from well activity to processing and exporting on our Bakken Infrastructure Map.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Fueling Up for Success: Harvest Midstream, Hilcorp's Affiliate, to Acquire Bakken and Eagle Ford Assets from Paradigm

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/140Blog_Paradigm_Acquisition_by_Hilcorps_Harvest_Midstream.png)

Harvest Midstream, a Hilcorp affiliate, is set to acquire three midstream gathering systems that serve the Bakken, as well as system located in the Eagle Ford. Harvest, an affiliate of Hilcorp Energy Corp, has entered into an agreement to purchase three Bakken midstream gathering systems and one in the Eagle Ford from Paradigm. Paradigm is set to sell these midstream assets to Harvest in the near future.

Restructuration is in a full-speed: Comstock to sell Bakken for $154 million

Comstock Resources decided to go through with asset divestment, selling its Bakken Shale actives for $150M to Northern Oil and Gas. The proceeds from these sales will be reinvested by Comstock Resources Inc. into the Haynesville Shale, at which point the company may acquire additional leasehold and fund drilling activities starting in 2022. Meanwhile, Northern clearly gunning for the pack leading position in the Texas shale play, but whether they succeed or not is remains to be seen.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R265_Blog_Williston Basin Overview_ 2022 vs 2023, Bakken Shale, Operators, Deals, 2024 Update.png)

The Williston Basin is a big area filled with layers of rock that sits next to the Rocky Mountains in western North Dakota, eastern Montana, and the southern part of Saskatchewan in Canada. This area covers roughly 110,000 square miles. Geologically, it's very similar to the Alberta Basin in Canada. People started drilling for oil in the Williston Basin back in 1936, and by 1954, most of the land where oil could likely be found was already claimed for drilling. The Bakken Formation with parts of Montana, North Dakota, Saskatchewan, and Manitoba has become one of only ten oil fields globally to yield over 1 million barrels per day (bpd) since the late 2000s. It is currently the third-largest U.S. shale oilfield, behind the Permian and Eagle Ford. The boom in the Bakken started around September 2008, coinciding with the U.S. housing market crash. The application of new technologies, such as swell packers enabling multiple-stage fracturing, significantly enhanced oil recovery, making the Bakken Formation a key player in the U.S. In 2022, the Bakken oil field saw big improvements in how much oil and gas it could produce. At the start of the year, 27 drilling rigs were working there, more than double the 11 rigs from the start of 2021. Important upgrades included making the Tioga Gas Plant able to process 150 million cubic feet more gas each day, and making the Dakota Access Pipeline bigger, increasing its oil transport capacity from 570,000 to 750,000 barrels every day.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/266_Blog_Continental Resources's wells in southern Midland and Ector counties, Texas.png)

Continental Resources is expanding its operations in the Midland Basin, including taking over some assets that used to belong to Occidental Petroleum. The company plans to use its expertise in exploration in this area.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R267_Blog_EQT and Equinor Swap Marcellus Shale, Strengthen Appalachian Onshore Assets in the US.png)

Equinor and EQT Corporation have agreed that Equinor will exchange its operated assets in the Marcellus and Utica shale formations in Ohio for a stake in EQT’s non-operated interests in the Northern Marcellus formation.